Performance textiles group Low & Bonar is forecasting a significant hike in full-year profits after making “strong progress” in the first six months of the year.

Outgoing chief executive Steve Good said the company which started life as a Dundee jute merchant, and continues to employ around 120 workers in the city was in a “great place” ahead of his departure in September, when new CEO Brett Simpson takes the helm.

L&B revenues on a constant currency basis increased 10.2% to £196.3 million in the six months to May 31, and pre-tax profits in the period rose £1.8m to £5.2m.

The performance was set against weaker comparatives in 2013 when returns from its civil engineering and building products divisions were hit by poor weather.

However, revenue streams are traditionally weighted towards the second half of the year, and the firm is confident of delivering a step up in full-year profits.

Analysts’ consensus for the full year is for total revenues in the range of £421m and adjusted pre-tax profit of £29.1m, an increase of £3m on last year.

“Sales and profits are well ahead of the previous year both on an actual and constant currency basis,” Mr Good said.

“Our acquisition (Slovakia-based Texiplast, now rebranded Bonar Geosynthetics) has been integrated and the synergies are coming through as expected.

“We are confident of making significant progress this year financially and strategically.”

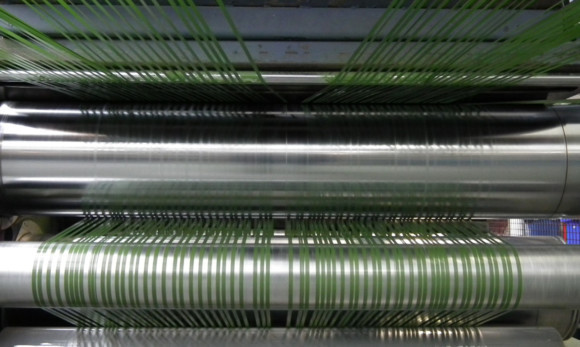

The firm’s yarns division which produces artificial grass sports surfaces and carpet backings at Caldrum Works in Dundee and at a sister facility in Abu Dhabi saw revenues increase by 30.4% to £17.9m in comparison with the previous year. However, the division fell to an operating loss of £100,000 in the period from a £300,000 profit in 2013.

L&B said new products were helping increase sales in a highly competitive marketplace, but the division’s outcome was hampered by pressure on margins.

The company said it had been given greater flexibility by securing a new five-year revolving credit facility worth up to 165m euros.

Chairman Martin Flower said that, currency headwinds aside, L&B was showing significant momentum.

“During the last two years the group has increased investment levels and built organisational capability to better position itself globally.

“We are now benefiting from these investments and expect to continue to grow and extend our geographic reach over the next two years.”

Analysts Jon Lienard and James Tetley at N1Singer said: “The investing for growth strategy continues to progress, and we continue to see upside within the group via organic investment, acquisition and divestment.”

Shares closed up 3.5% or 2.75p at 81p.