The chief executive of an English optical components firm has the infrared market square in his sights after snapping up a specialist Fife firm in a £6.6 million deal.

Gareth Jones, chief executive of AIM-listed Gooch and Housego (G&H), said the purchase of Glenrothes-based Spanoptic significantly increased his firm’s capabilities and would allow it to broaden the scope of its infra-red related work, which is particularly important in the aerospace and defence arenas.

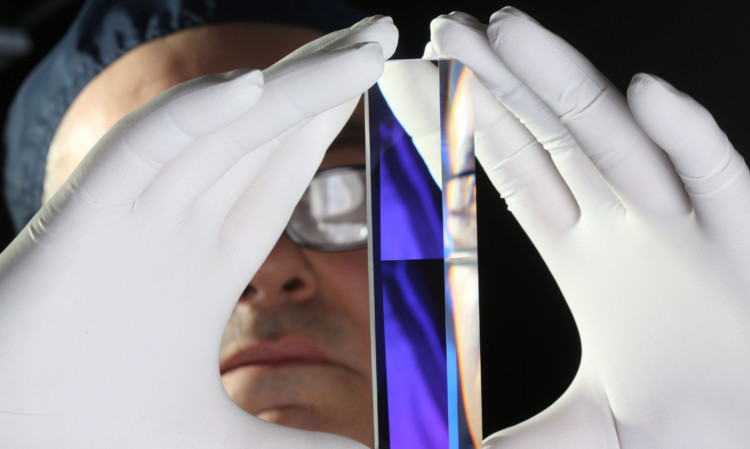

Precision optics are used in a wide range of industrial applications including semi-conductor manufacture, lasers, sensing, imaging and the life sciences and are an integral part of many critical systems used within aircraft and military hardware.

G&H is a long-term supplier of ring laser gyroscopes which form part of the guidance systems used on Airbus and Boeing 747 aircraft.

Mr Jones, who travelled to Fife to announce the acquisition to Spanoptic’s workforce in person, said the two businesses had great synergies.

“Spanoptic is very much complementary to our business,” Mr Jones said.

“Gooch & Housego is in a similar field in the manufacture of precision optics but where our optics are predominantly planar mirrors and prisms Spanoptics are more curved lenses.

“Also, we tend to specialise in optics that are used in the visible part of the spectrum while Spanoptic have capabilities in infra-red which is very important in the aerospace industry.

“Adding that capability to our existing capabilities is a very nice thing to do.”

Spanoptic was founded in 1976 by John Bryden and has since grown to become one of the UK’s leading independent manufacturers of spherical and aspheric lenses and diffractive optics with applications in the ultraviolet, visible and infrared spectra.

The firm, which has 62 employees and which made a £1m pre-tax profit in 2012, has had a long-term working relationship with G&H and Mr Bryden’s wish to retire from day-to-day business life sparked the takeover talks.

Mr Jones said it was business as usual at the Glenrothes plant following the acquisition.

“There will be very little change,” Mr Jones said. “What we have done with other businesses we have acquired is invest and develop them over the years.

“We have got an excellent workforce at Glenrothes and we have a good facility and, if we were to do something like move that somewhere else, the people would be lost to us and the skills would be lost to us.

“We want to keep those skills in place so therefore it will be business as usual (at Glenrothes) and that same message goes for our customers.

“It is just a change of management. The company has benefited from considerable investment in recent years and it is important to us that the business remains successful.”