Payday loans should be avoided in the run-up to Christmas as they could cause continuing anguish for hard-up debtors.

Angus Citizens Advice Bureau issued the warning as it released details of the number of people asking for help after being caught in spiralling debt crises.

The branch has helped people with 1,968 debt inquiries this year, many involving high interest rate loans.

They include inquiries about lenders who breached the Payday Loans Good Practice Charter, which was signed by 90% of lenders a year ago.

Angus CAB is concerned increasing numbers of financially vulnerable people may turn to payday lenders during the winter months.

The UK Government has plans to cap the cost of payday loans by early 2015, but Angus CAB said it has seen loans currently available for as high as 2,610%.

A spokesman for the Angus CAB said: “It is predicted that as both the winter months and recent welfare reforms begin to bite, greater numbers of financially vulnerable individuals may turn to payday lenders as a solution.

“Payday loans may provide a speedy short-term solution, but can create a very long-term problem and can increase debt.

“Borrowers need to be certain of being able to pay back the loan, plus the interest, within the loan period to be rid of the debt. This almost never happens and typical borrowers struggle to pay back simply the interest.

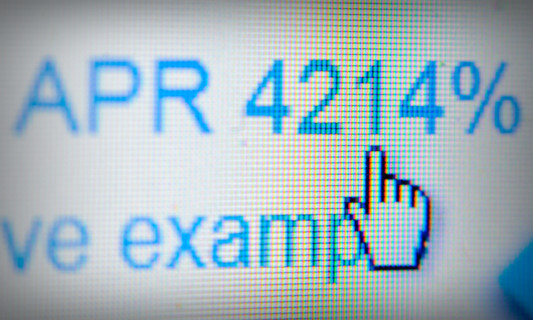

“For example, to borrow £100 over one year, some lenders would charge up to 2,610.16% APR (annual percentage rate), which means a massive £2610 must be paid back by the end of the year.”

This can lead to people taking out further payday loans to make the payments on the initial agreement.

Angus CAB, which has offices at Millgate, Arbroath, Queens Street, Forfar and Castle Street, Montrose, can provide debt advice and helps people to consider all options open to them.

For example, a loan from Angus Credit Union, at a rate of 12.69%, can be much more affordable.

“It may be possible to agree an overdraft with their bank, if a prospective borrower already has a bank account,” the spokesman continued.

“Borrowers should be careful of going overdrawn without permission and make sure they understand any fees and charges.

“Avoid payday loans in general. Instead, prospective borrowers should contact their creditors and agree a repayment plan.”

Those who already have a loan and are struggling to repay it or believe they are being treated unfairly by a lender, are invited to share their experience via the CAS survey.This can be found at www.facebook.com/CitizensAdviceTayside.

Help with debts is available from www.adviceguide.org.uk/scotland or and Angus CAB offices.