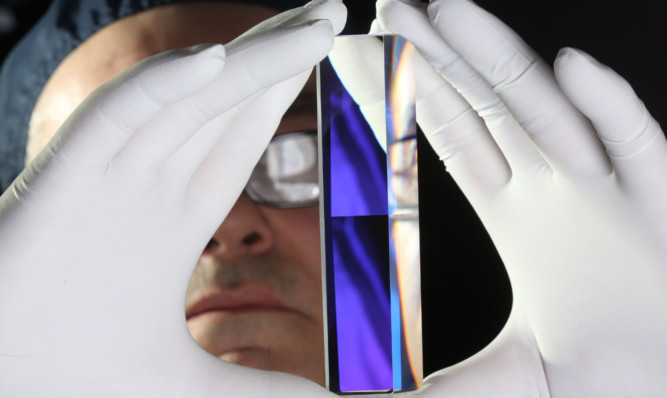

Spanoptic, the Glenrothes manufacturer of precision optical instruments for aerospace and defence industries, zoomed in on an impressive 40% rise in pre-tax profit.

The £1.4 million made by the company before paying tax came from a turnover up 10.6% at £6.8m.

The Fife company’s £6.6m takeover by global photonics company Gooch & Housego was completed during the year to September 2014.

The parent company said its acquisition of Spanoptic opened up new opportunities with aerospace, defence, supply chain and manufacturing partners in China.

Gooch & Housego chief executive Gareth Jones said Spanoptic was one of two acquisitions that made a positive contribution to revenue and profit.

The takeovers also brought valuable additional products, capabilities and customers.

Spanoptic’s advanced lens manufacturing and infrared optics capabilities had substantially broadened Gooch & Housego’s precision optics products and opened up new opportunities, particularly in aerospace and defence.

Spanoptic director Andrew Boteler said the Fife company’s board was satisfied with the performance for the current financial year which it expected to be maintained.

“The company prides itself on the highest standards of product quality and customer satisfaction,” he continued.

“In doing this it recognises that a failure to maintain such standards would be detrimental to its future trading performance.”

Spanoptic recognised the importance of retaining and developing its highly skilled management team and workforce to achieve its strategic objectives.

A development and reward scheme encouraged individuals to play a long-term role in the development of the company, and staff costs rose by 12.65% to £1.6m for the 59 personnel.

Gooch & Housego’s turnover was up 10.7% at £70.1m.

Statutory pre-tax profit was down 4.8% at £7.9m reflecting costs for closing operations in New Jersey and Melbourne and writing-off goodwill associated with 2011 acquisitions.

The group had a one-off benefit associated with the gain on acquisition of Spanoptic, however.