INVESTORS DESERTED Dunfermline-based retinal imaging firm Optos yesterday as the company admitted its second- quarter sales performance would not meet management expectations.

Shares in the AIM-listed group closed the day down, after plunging to a low following an update branded “disappointing” by analysts.

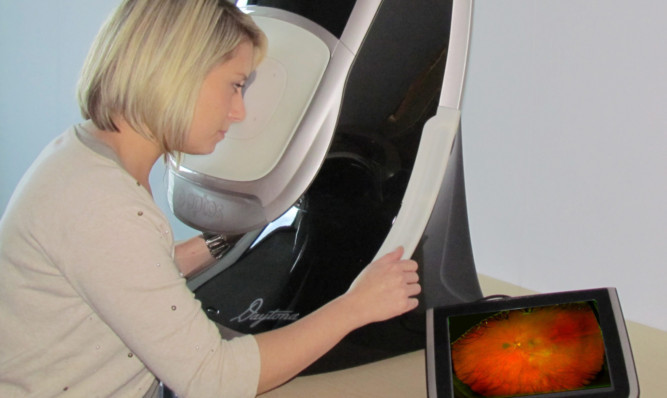

Optos blamed the ongoing development of a new software iteration for its pivotal Daytona scanning system and weakness in challenging European markets for the “lower than planned” returns.

But chief executive Roy Davis said he was confident that the shortfall would be made up during the traditionally stronger second half, and revealed details of a previously announced mass order of 250 units from a major optometry brand based in Australia and New Zealand.

“Q2 performance will be lower than planned. However, the additional order of 250 devices by a major corporate such as OPSM is a clear demonstration of both the value and potential of our technology,” said Mr Davis.

“Given positive feedback from the market and our sales teams, and as we move into our historically stronger second half, our expectations for the full-year remain unchanged although it will be more weighted to the second half than previously anticipated, as it was last year”.

The deal with OPSM will see the Daytona scanner used across the high street brand’s store network, he added, “validating” the importance of the technology and Optos’ antipodean partnership strategy.

The units will be supplied on exclusive rental contracts, alongside some 160 devices already in use by the chain.

OPSM and Optos have also agreed to share technology development and work together on market commercialisation.

Mr Davis said other customers were waiting until updates and enhancements were complete before ordering machines, skewing sales into the second-half.

He also highlighted that net debt would likely show an increase in May’s interim results announcement, thanks to costs associated with an increased rental sales mix.

Analysts also remained chipper on the firm’s prospects.

Julie Simmonds at Canaccord Genuity said Optos’ share price weakness provided an opportunity for buyers to snap up a stake.

She also highlighted how OPSM’s Italian parent Luxottica is focused on a roll-out of high-end eyecare chains in the Asia-Pacific region, adding that such a partnership “bodes well” for Optos in the longer term.

“The trading update is disappointing. However, we believe the long-term opportunity for Optos from both Daytona and its future product launches remains,” Ms Simmons wrote in a note.

“Daytona allows Optos to address geographies which have not previously been accessible.

“Optos currently has an instrument in around 12% of US optometrists, versus less than 1% outside the US.

“Hence, we expect ex-US sales (particularly to the emerging markets) to ramp once the software issues are resolved.”

In January, Mr Davis told The Courier he expected Optos which employs 185 highly-skilled staff at its Carnegie Campus headquarters and manufacturing site to significantly increase sales of its technology this summer.

The firm, which already has 100 sales reps in the USA, saw strong underlying growth of 18% in the first quarter, and hopes to be “getting into distribution big time” during the second half of this financial year and the early part of the year to come.

business@thecourier.co.uk