Britain’s banks have been told they must hold an extra £25 billion in reserve to help them guard against the impact of financial crises.

The Bank of England said the UK’s biggest lenders did not have enough capital to cover themselves in the event of a potential £50bn hit from eurozone shocks, bad debt on property loans, and mis-selling scandals.

Its Financial Policy Committee said regulators will order the banks to plug the gap by the end of the year so they are better prepared to withstand strains on their balance sheets and future shocks in the market.

Further increases in capital ratios may also be required in successive years, the bank warned.

“The actions that banks need to take depend on whether, and if so how far, their adjusted capital falls short of the level that the FPC judges banks need to ensure sufficient capacity to absorb losses and sustain lending in the current conjuncture,” its report said.

Banks and building societies will need to meet the gap by raising new capital or restructuring their balance sheets and there are fears that could have a negative impact on lending to business, despite the Bank stressing that fund-raising must be done in a way that “does not hinder lending to the economy.”

The Treasury has said the taxpayer will not put any more cash into state-backed lenders RBS and Lloyds.

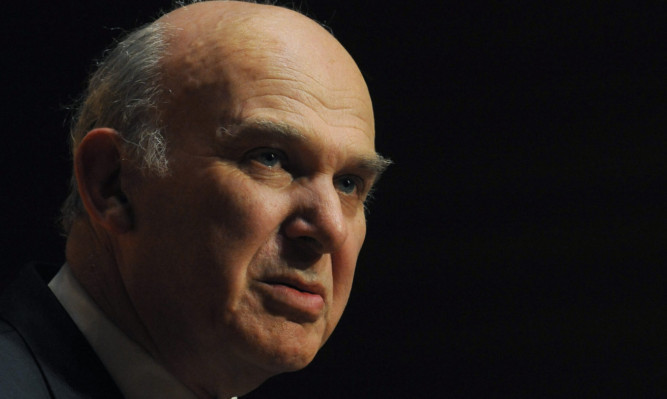

Business Secretary Vince Cable said the idea of banks being forced to raise funds during a recession was “erroneous”.

“This FPC exercise will prolong the time it takes for the British economy to recover by further depressing already-weak SME lending,” he said.

PwC banking director Richard Barfield warned banks may be forced to cut credit available to borrowers.

“Without external capital-raising, the principal way for banks to achieve more demanding capital ratios would be to reduce lending or carry out more de-leveraging, which is not conducive to economic growth,” he said.

The FPC, chaired by governor Sir Mervyn King, did not identify the most poorly-placed lenders, but it is widely-regarded as likely RBS and Lloyds are amongst those not measuring up to the standard set out by the FPC.

However, RBS issued a statement saying it had a strong capital position and would continue to work with regulators to ensure it remained “at the forefront of international capital standards”.

Shares in the Gogarburn-based bank fell 3.1% at the close, while stock in Lloyds climbed 2.2%.

The capital figure was not as bad as a £60bn shortfall some in the City had feared.

Analysts at Investec said they believed the Bank of England’s intervention would have little effect.

“Do not be misled by the headline of a ‘£25bn capital shortfall’; we expect it to have a very limited impact on the banks’ existing capital plans,” the broker said.

“Importantly, there is no trigger for any fresh equity issuance, with a new recommended end-2013 capital target of ‘7% of risk weighted assets’, albeit after making higher allowance for future credit and redress costs and a more prudent calculation of risk weights.”