Whisky distiller Whyte & Mackay doubled profits to almost £30 million last year as the bulk of the Indian-owned Glasgow giant gets set to go under the hammer.

Documents posted at Companies House showed the group which has production and warehousing operations across Scotland grew turnover by more than 20% to £277m during the year to March, leaving pre-tax returns 91% higher at £29.5m.

The accounts were made public a matter of hours after Whyte & Mackay’s parent, United Spirits (USL), revealed its board had agreed to “explore the potential sale” of its Scottish subsidiary.

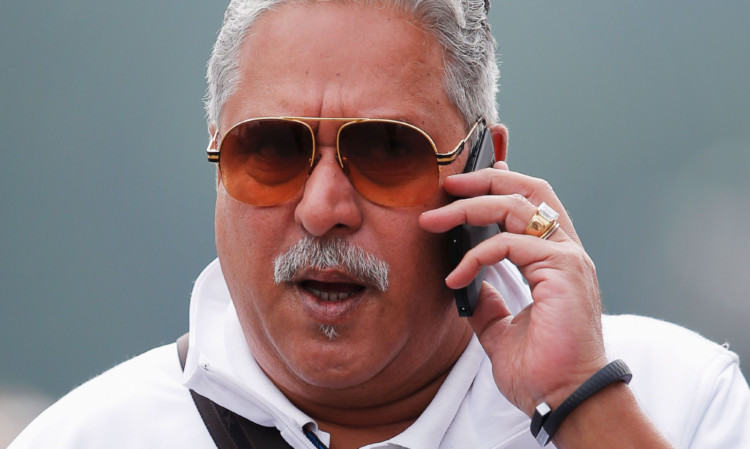

Drinks giant Diageo effectively took control of USL early last year, through a voting rights pact agreed with its tycoon chairman Vijay Mallya. The group behind Guinness and Smirnoff had hoped to take a majority interest in USL’s shares, but has been frustrated by low take-up of its offer and an adverse court ruling over money owed by Dr Mallya’s grounded Kingfisher Airlines.

The management agreement has also prompted regulatory concerns over the potential for anti-competitive pricing in the UK blended Scotch whisky market, where Whyte & Mackay is in direct competition with major Diageo brand Bells.

Diageo which is represented on the USL board by former CEO Paul Walsh has offered to sell the bulk of the Whyte & Mackay business, with the exception of the Dalmore and Tamnavulin malt distilleries in north-east Scotland, in an effort to calm fears at the Office of Fair Trading.

Whyte & Mackay’s Invergordon, Jura and Fettercairn distilleries, and all of its central operations, are expected be marketed under the proposed remedy, with Diageo more interested in making gains in a growing Indian market.

Dr Mallya, who also owns the Sahara Force India Formula 1 motor racing team, bought Whyte & Mackay for around £595m in 2007.

“The board proposes to initiate a process, based on the outline timetable provided under UK law in connection with the decision of the Office of Fair Trading, to explore a potential sale of W&M,” a USL statement to the Bombay stock exchange said.

“The board has nominated certain persons to oversee the process and consider, examine and evaluate possibilities and structure in relation to a potential sale, appoint necessary advisers in this regard and identify potential purchasers.”

It is expected that any would-be purchaser must be approved by the OFT to prevent the matter being referred to a full Competition Commission inquiry. Former owner Vivian Imerman and the Japanese owner of Bowmore, Suntory, have both been touted as potential bidders.

Late last month Whyte & Mackay’s production arm posted turnover of £263.4m for the same period, and increase of 16% on the previous year, and pre-tax profits of £33.5m.