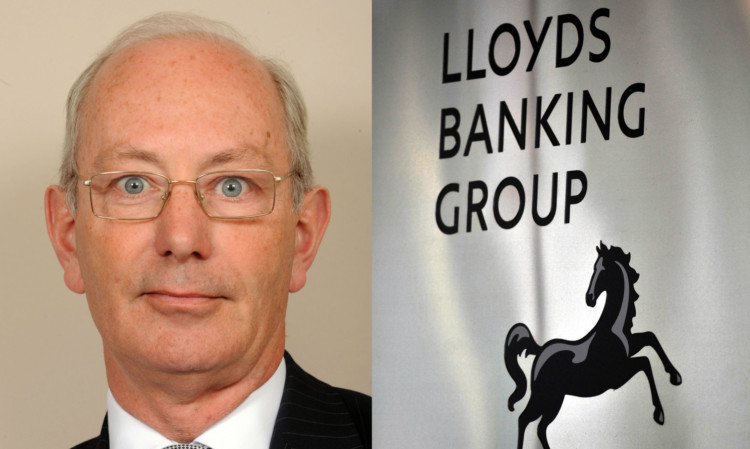

Former Downing Street adviser Lord Blackwell is to become the next chairman of state-backed Lloyds Banking Group, the bank has confirmed.

The widely-anticipated move will see the 61-year-old peer, who worked for both Margaret Thatcher and John Major, succeed retiring chairman Sir Win Bischoff, 72, in April.

Lord Blackwell, the chairman of Lloyds subsidiary Scottish Widows, has held a number of senior positions in banking and insurance, including roles at NatWest and Standard Life.

He spent 15 years with management consultants McKinsey and has served on the boards of regulators OFT and Ofcom.

“I am honoured to have been asked to become chairman of Lloyds Banking Group,” he said.

“I would like to thank Win for the outstanding job he has done in steering the bank through a tremendous turnaround,” he added.

“This is a great opportunity to be part of helping the bank go even further in serving customers, and supporting the UK economic recovery as it returns to full private ownership.”

Cambridge-educated Norman Blackwell served as a Downing Street adviser under Mrs Thatcher in the 1980s, and headed the Number 10 policy unit in the Major government from 1995 to 1997. He was appointed a life peer in 1997.

He is a member of the board of right-wing think-tank the Centre for Policy Studies, and has served on the Lloyds board since June last year. Lord Blackwell has been chairman of support services and construction firm Interserve since 2006.

Sir Win was appointed chairman of the bank in September 2009, a year after it had to be bailed out with £20 billion of taxpayers’ money. He announced in May that he was to retire.

“I am delighted Lord Blackwell has been chosen to succeed me as chairman,” he said.

“Over the past four years, the group has made significant progress in its goal to become a strong, efficient, UK-focused retail and commercial bank.

“Whilst clearly some challenges remain, the performance of the group is well on track.”

The retiring chairman has overseen the restructuring of the bank in conjunction with chief executive Antonio Horta-Osorio, the former UK boss of Santander who took over at Lloyds in 2011.

It comes as the bank, which remains 33% taxpayer-owned, prepares for the return of the stake to the private sector, having disposed of a 6% chunk for £3.2 billion in September.

Stock in the group closed up 1.2p at 78.6p.