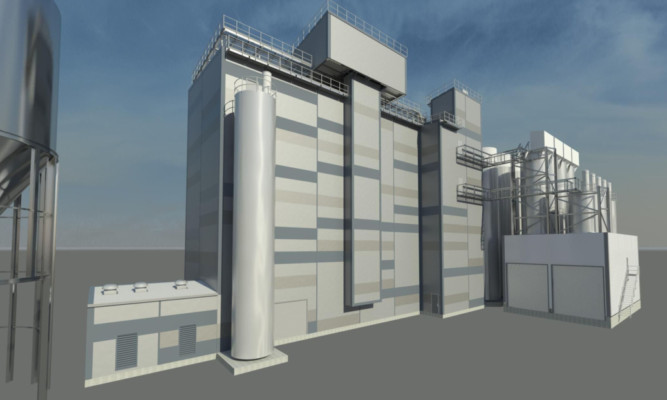

Cumbrian agriculture, food and engineering group Carr’s said its new £17 million Kirkcaldy facility is on-track for commissioning later this year, as its milling arm prepares to rely on imported grain for a second successive season.

The group said a cold, wet spring would likely lead to reduced yields from domestic harvests this autumn, causing further reliance on wheat from overseas.

Last year’s “exceptionally poor” crops led to what it called a “significantly greater” dependence on grain from abroad, but Carr’s said portside facilities like Kirkcaldy, and its mill at Silloth on the north Cumbrian coast, gave it an advantage over its competitors.

It said the two sites gave it cost-effective access to imported crops, contributing to a continuing pattern of strong financial performance across the group during the four months to the start of July.

An interim statement to the markets revealed that the milling division’s financial performance had begun to improve, despite the industry being “plagued by over-capacity and volatile input prices for years”.

But the firm highlighted the impact of the closure of a competitor mill in Glasgow, which eased pressures in the Scottish market, and the opening of the new Fife facility as particular bonuses.

The new Kirkcaldy plant is expected to result in “significant efficiencies and improvements in operating margins” following its opening in September.

The Fife facility, backed by grant funding awarded through Scottish Enterprise, is the first new flour mill to be built in Scotland for 30 years, and replaces the established Hutchisons Mill.

Carr’s say the project will secure more than 70 long-term jobs in the town, while creating 100 during construction. The development was made possible by the reopening of the Port of Kirkcaldy and dredging works carried out by owner Forth Ports in late 2011.

Carlisle-headquartered Carr’s, which also has milling operations at Maldon in Essex, said its agricultural feeds division continued to benefit from the poor weather until well into May.

It said British farmers spent more on feeds, licks, animal health products and fuels, while US droughts boosted sales on the other side of the Atlantic. It paid £600,000 for Nevada-based Western Feed Supplements in June, as it seeks to supply the dairy and beef markets on the US Pacific coast.

Sales of machinery and implements fell back thanks to the pressure on farm incomes, but Carr’s said the network continued to perform “well”, with investment continuing.

Engineering revenues also continue to build, as a result of “increasing global demand” for remote handling equipment and robotics from the nuclear and petrochemical industries, a new contract at Sellafield on the Cumbrian coast, and with Hyundai to supply pressure vessels to the Schiehallion field west of Shetland.

Net debt reached £28.4m thanks to capital expenditure across all divisions, but Carr’s recommended an increased second interim dividend of 7.75p per share.