The UK Government has begun discussions with regulators following a rising tide of complaints over fixed-rate loans it is claimed were mis-sold to small business owners.

The Courier understands that officials from the HM Treasury have met counterparts at the Financial Services Authority over the problems created by fixed-rate loans containing embedded derivatives.

Lobby groups say experts have shown the loans which are not included in an FSA-approved review and compensation scheme act in a very similar way to the interest-rate swaps, which have cost banks hundreds of millions of pounds in remedial payments.

Many claim they only discovered the five and six-figure breakage costs associated with the deals as they attempted to refinance in the aftermath of the 2008 financial crisis.

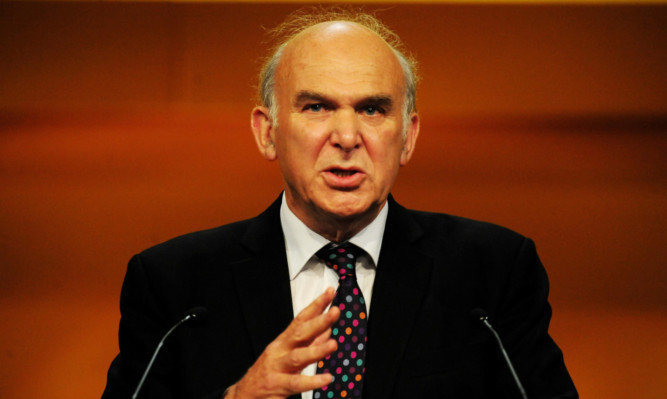

Business Secretary Vince Cable is set to take up the issue, saying the fixed-rate contracts could be “akin” to the mis-selling of swaps.

“I am going to ask the FSA to look at the question of whether these are comparable to part of the swap mis-selling problem,” Dr Cable said.

The news came after Financial Secretary to the Treasury Greg Clark appeared to confirm that the National Australia Bank-owned Clydesdale would review one customer’s fixed-rate loan during his answer to a parliamentary question earlier this week.

In a move which it has been claimed could open the floodgates to tens of thousands of similar actions against the banks, Mr Clark told the House of Commons that the Glasgow-based lender had agreed to consider a specific tailored business loan as part of its review into mis-selling of interest rate swaps.

Dundee business man James Boyle, who was named by city MP Jim McGovern in the question which prompted Mr Clark’s intervention on Tuesday, last night said he was “happy” at the Government’s apparent confirmation that the Clydesdale would be reviewing his case.

Business people and campaigners in the east of Scotland have already banded together to form a local chapter of the NAB Support Group, which is affiliated to the Bully Banks campaign and supports those SMEs seeking to challenge what they see as the mis-selling of their loans.

But a spokesman for the Clydesdale restated its insistence that none of its fixed-rate tailored business loans were being reviewed, and instead stressed that its normal complaints procedures remained open to dissatisfied customers.

“I can confirm the product in question is a fixed-rate TBL and is therefore out of the scope of the review,” a spokesman said.

“We are not looking at any fixed-rate TBLs as part of the review but have been clear from the outset that we will look at any complaint about product sales within our existing complaints process,” added the spokesman.

Mr McGovern said he would be seeking further clarification from Government over the issue.

“It beggars belief that products that look like, sound like and smell like the products currently being investigated by the FSA have not been included in the thorough review now under way,” he said.

business@thecourier.co.uk