Gooch & Housego, the specialist manufacturer of optical components and systems with a presence in Fife, is confident of emerging well from a tougher start to the year.

Revenue in the six months to March 31 was down £500,000 to £38.4 million and adjusted pre-tax profit was down £700,000 to £5.6m.

Chief executive Mark Webster said the first half performance of the Somerset-based group was expected.

The industrial laser market was weaker in the first half because of lower demand from China for lasers in microelectronic manufacturing, but he said that market is recovering.

The aerospace and defence market, characterised by high-value, long-term programmes involving US and European defence contractors, is also recovering after being down in the first six months.

The group enjoyed a strong performance from telecommunications and fibre sensing products, and revealed a robust order book up 13.1% at £39.1m at March 31.

Mr Webster commented: “G&H is well-positioned to benefit from improving market conditions and has the capacity to respond to increasing demand.

“Our commitment to diversification has enabled us to navigate a challenging period at the beginning of the year and still be on track to deliver our full year expectations.

“We remain committed to our strategy of diversification and moving up the value chain whilst continuing to invest in our continuous improvement programme, which will underpin future performance.’’

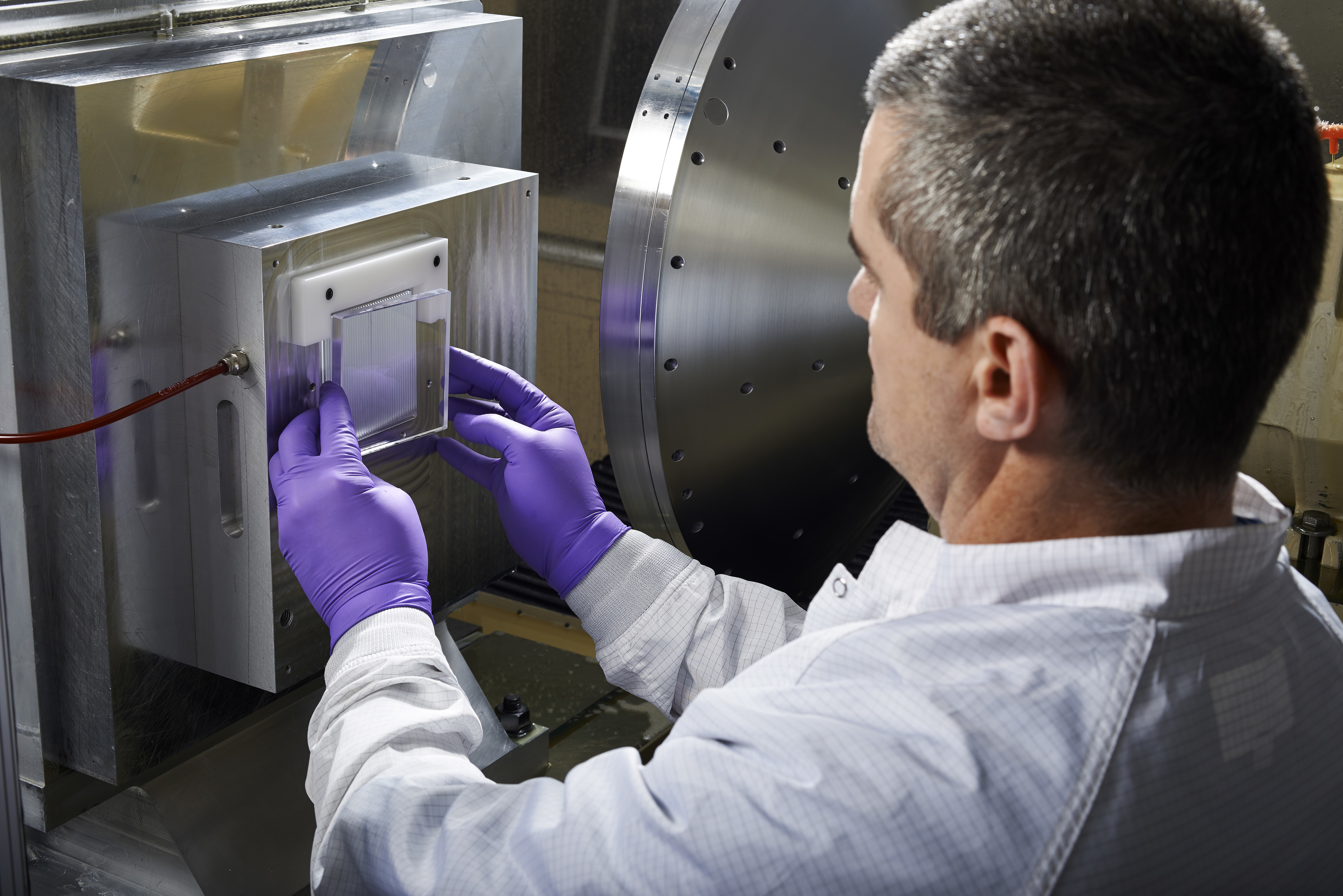

The group invested £3.5m in Research and Development (R&D) in the half year, representing 9.1% of revenue and 8% higher than the same period of last year.

That continued commitment to targeted R&D was bearing fruit, the group said, with a record 13 new products launched at a major trade show.

The group’s operations include Spanoptic in Glenrothes, the 60-employee site which makes precision optical instruments for aerospace and defence industries.

Mr Webster said the group was very happy with the performance of its Fife base, with new key personnel in place to work in important markets with growth potential.

Spanoptic’s pre-tax profit fell by more than £1m to under £400,000 in the year to September 2015, but Mr Webster said the results covered the first year of its integration into the parent group and were not representative of performance.