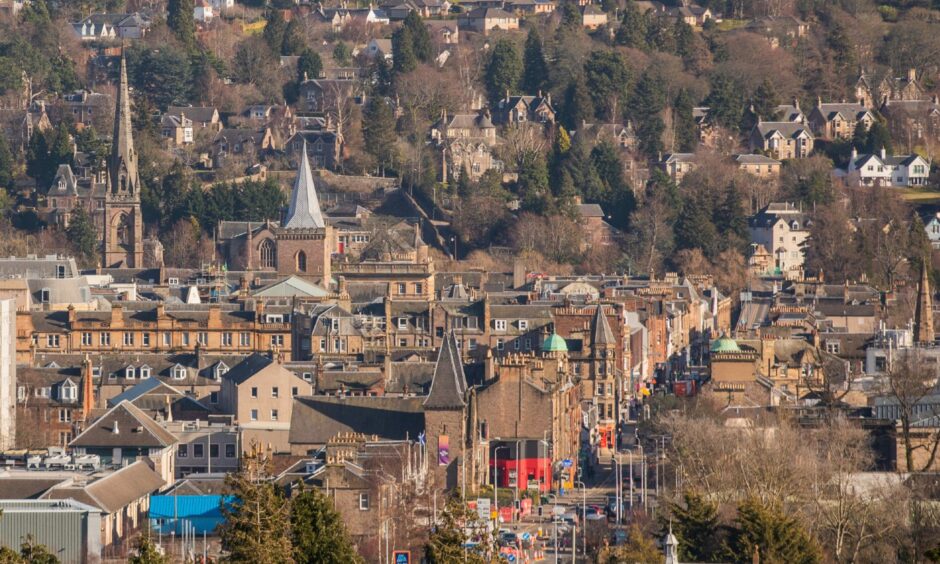

The number of residential properties for sale in Dundee has almost halved in the past year as house prices accelerate.

A new analysis found the number of homes on the market fell by 46% between January 2021 and 2022.

Letting and estate agent DJ Alexander found the amount of property stock in Perth fell by 40% over the same period.

The estate agent’s chief executive David Alexander says there is a “severe shortage” of properties across Scotland.

Meanwhile many homes available for sale are snapped up quickly.

House prices in Dundee rose more than 11% last year.

Time on Dundee property market slashed

In January 2021 there were 370 properties on the Dundee market. This year the number dropped to 201.

The biggest fall in properties available in Dundee is detached homes with 54% fewer compared to last January.

The number of flats is down 51% while the volume of terraced homes has fallen 48%.

Mr Alexander said: “The time properties spend on the market has been slashed in the last year with larger homes selling much more quickly.

“Four-bedroom properties have seen their average time on the market cut by 49% with three-bedroom properties reduced by 11%.”

A local estate agent believes first time buyers will struggle to get on the Dundee property ladder this year.

Gilson Gray’s Lindsay Darroch said competitive mortgage deals, demand from property investors and low property stock are among the reasons for increasing house prices.

There is also “crazy” high demand in the Dundee property rental market.

Dundee and Perth reduction in large homes

In Perth, the biggest reduction in volumes is among larger properties.

There is a 60% reduction in terraced properties, 55% fall in detached homes and semi-detached properties are down 40%.

Semi-detached properties in Perth have seen their average time on the market cut by 68% and by 24% for detached homes.

There were 208 properties for sale in Perth last January, and 124 this year.

Mr Alexander said: “We can see there are fewer larger homes available in Dundee and Perth.

“Those that are available have had their time on the market cut substantially.

“Demand for larger homes in the two cities has undoubtedly risen during the pandemic.

“These figures highlight that there is now a shortage of properties available which will result in higher prices and shorter selling times for those that come to market.”

Six estate agents from across Tayside and Fife have predicted how much prices will rise in 2022.

Why is property stock low?

Due to the pandemic, a substantial period of house building was lost, and there were both labour and material shortages.

Mr Alexander said new properties have to be built each year to keep up with demand.

If building stops for even a short period the impact is substantial on demand.

A Broughty Ferry bungalow recently sold for £100,000 more than its home report value.

The property expert also highlighted a return of EU nationals and others to work in Scotland as a reason for low stock.

How does the Scottish property market look?

Overall, the number of properties available for sale fell by between 31% and 47% year on year between January 2021 and 2022.

The outlier is Aberdeen where the fall in volumes was down just 3%.

The highest drop in property numbers occurred in Stirling with 47%, while Glasgow is down 45% and Edinburgh fell 42%.

Mr Alexander does not predict a fall in house prices.

He said: “We are going to experience some brakes on the pace of demand in the property market, but these may be mitigated by pressure from the lack of available stock.

“Property prices will perhaps slow in the coming months from their current substantial growth, but I don’t think we will see any sudden slowdown or reversal.

“I can see demand being sustained into the summer and autumn of this year with perhaps a slowdown toward winter.

“The various financial impacts of rising base rates, higher national insurance, increasing utility costs, and growing food prices will start to impact upon budgets and lifestyles reducing the availability of buyers with as much to spend on housing.

“As long as demand and supply remain at these levels it is hard to see any dramatic fall in prices.”