How will rising energy bills and the higher cost of borrowing money impact the housing market in Tayside and Fife?

With more and more households feeling the pinch, buying a house might feel out of reach.

There are also speculations the market could crash because of rocketing inflation and costs.

However, Fife Properties managing director Jim Parker feels prices will ease or fall in the next year.

He said: “This quarter, supply of housing has increased 32% coupled with a 10% drop in demand.

“There is no doubt the momentum in the Fife housing market will be slower in the next 12 months.

“Nevertheless, I anticipate Fife house price growth to ease and in some months be slightly negative.

“The boom is over, yet it shouldn’t be a bust.”

Advice for home owners

After two “exceptional” years at Premier Properties in Perth, director Katie Hall feels a change coming.

Rather than go down, she thinks house prices are about to stabilise. Because interest rates are on the way up, she has a tip for all home owners.

“My advice to anybody nearing the end of their fix rate deal is to speak to their bank or mortgage broker, take advice and to go over all their options.

“In truth, we don’t know what’s going to happen. After all, no one predicted the scale of the housing boom that happened after lockdown in the summer of 2020.”

Despite interest rates, inflation and bill rises, RSB Lindsays Dundee partner Chris Todd says buyers and sellers are not put off.

As long as lenders are willing to lend, he does not expect house prices to drop.

“The dominating feature in the property market here remains that demand is outstripping supply across all home types,” he says.

“That was the case before the current financial challenges and I don’t see that changing quickly, albeit things are not at the dizzying heights we saw earlier this year and last year.

“While it’s too early to predict what the winter might hold, the challenging economic circumstances are currently a world away from the market collapse we saw in 2008.

“Announcements from the new Prime Minister about support for people with rising energy bills may also have a bearing on how the property market plays out in the months ahead.”

Cost of bills could influence move

At Thorntons Property, many homes are still selling for above home report value as buyers are still looking for extra room after the pandemic.

Operations manager Yvonne O’Connor says cost increases will eventually catch up with the property market, but house prices are unlikely to go down.

“If you are selling – although you might get slightly less for your property – you will also benefit when you come to buy your new home by paying less.

“Sales and new listings are holding up well and we would expect this to continue until the year end.”

In Perthshire, Possible director Gary Robertson is seeing an increase in activity since the schools returned.

He says this is a normal trend signalising that the market is returning to traditional trends.

“Some people may put moving plans on hold due to cost of utilities rising and interest rates,” he says.

“But they ultimately may also be the prompt for them to move to a different area where prices might be more reasonable in comparison to where they live.

“Essentially, there will always be a need for people to move home.”

Market ‘gets going’ by 2024

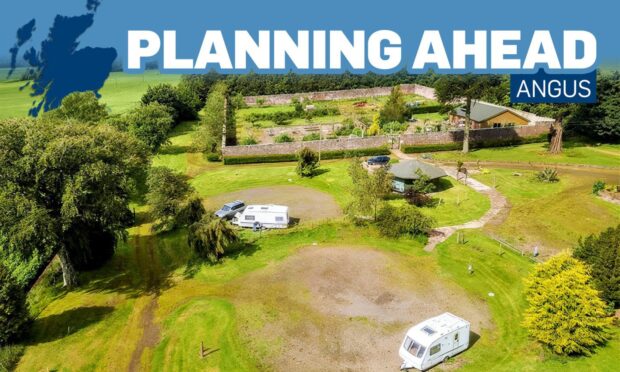

The strong prices and activity levels of the housing market in Dundee and Angus have “defied logic” according to Gilson Gray partner Lindsay Darroch.

However, the signs of a slight cooling are here with some houses taking longer to sell than anticipated.

Mr Darroch expects to see a contraction in activity from both buyers and sellers in October that will last for 18 months as the country works through its economic issues.

“I would anticipate that initially we will see a reduction in the number of people actively looking to buy and also see a reduction in the properties coming on the market.

“Whilst not being totally self-regulating, I do expect prices at worst to plateau.

“I would then see a period of forced sales either through financial or personal circumstances. Thereafter I would predict a steady increase in properties coming on the market and purchasers.

“My hope is that the property market really gets going by spring 2024.”

Conversation