The oil and gas explorer behind controversial plans to burn underground coalbeds beneath the Forth has surrendered its licences.

The move by Cluff Natural Resources will be seen as a victory for green campaigners who protested against the firm’s plan to source gas deposits by tapping and igniting coal seams far below the riverbed.

The company – led by North Sea oil and gas veteran Algy Cluff – revealed today it had handed back its nine underground coal gasification licences to the Coal Authority.

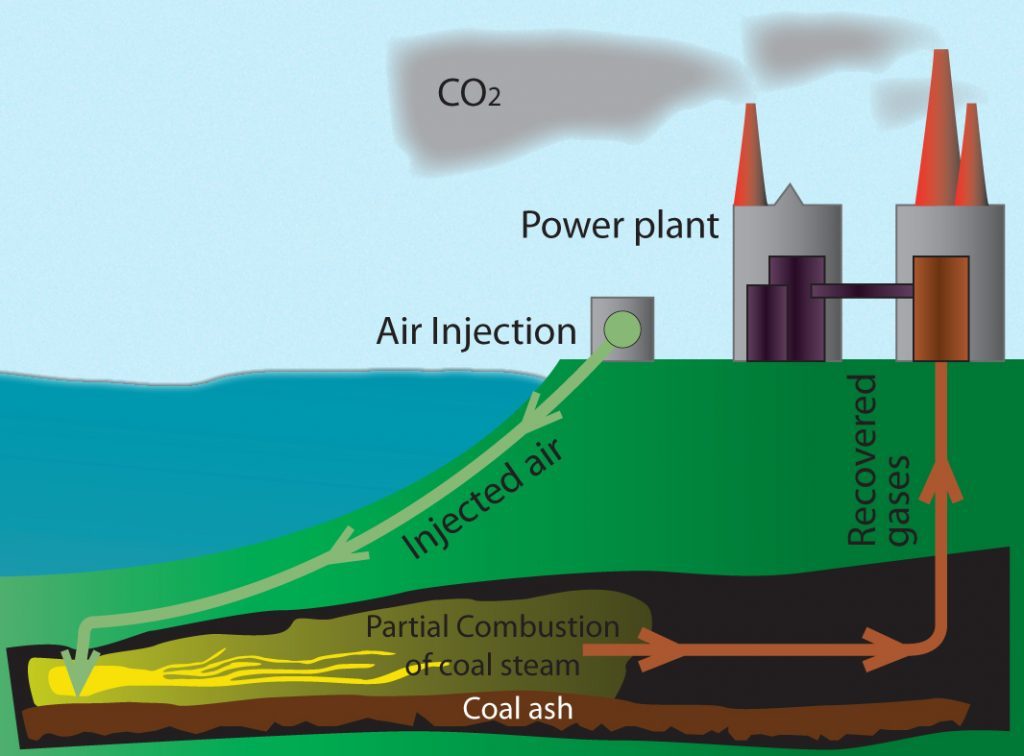

The company mothballed its UCG project on the Forth after the Scottish Government announced a moratorium on fracking and other unconventional energy projects.

Cluff fully wrote down the value of its UCG projects in its 2015 accounts but maintained its licence options. Those have now been relinquished.

Chief operating officer Andrew Nunn said: “In the absence of a supportive policy on UCG emerging from Westminster and the indefinite extension of the UCG Moratorium in Scotland, the company has today notified The Coal Authority, as the responsible authority for issuing UCG licences, that it is relinquishing its nine UCG licences.

“Given the uncertainty around the future of these assets which has existed for some time, these licences had already been fully written down in the company’s 2015 accounts.”

Instead of focusing on UCG, Cluff has spent the past months concentrating on developing its offshore gas assets in the Southern North Sea.

The firm’s two core licences include eight distinct prospects in five proven reservoirs.

Cluff’s preliminary results for the year ending December 31, show a pre-tax loss of £1.73 million, a slight improvement on the £1.88m loss of 2015.

Chairman and CEO Algy Cluff said the company’s destiny was directly linked to the North Sea.

He said there had been a significant improvement in sentiment both within and towards the oil and gas industry and the basin was on cusp of a new phase of its development through the bringing forward of small pool developments.

“Notwithstanding the apparent view of many of the major oil companies that the North Sea no longer offers the prospect of major discoveries (about which they may well be in error), it is widely agreed that there remain many licences which contain high quality exploration targets,” Mr Cluff said.

“Her Majesty’s Government has the power to render those targets even more attractive by fiscal incentive.

“Secondly, the North Sea is well run. Thirdly, it is secure. And, fourthly, it contains many existing discoveries – which the UK’s Oil & Gas Authority (OGA) estimates to be in excess of three hundred – which remain undeveloped.

“The OGA is due to announce the 30th round of licence awards and we are advised that this round will include such “small pools” of oil and gas which will reduce much of the exploration risks whilst offering, in some cases, immediate resources.

“We have been giving much thought to this eventuality and are determining how to respond with the intention of applying when the round is announced.

“It is my view that this could herald a North Sea Phase Two with the OGA estimating that as much as 3.4 billion barrels of oil equivalent is distributed amongst these pools.”

Shares in Cluff Natural Resources pushed more than 12% higher in early trading following the market update.