Shares in housebuilder Springfield Properties tumbled today after it revealed a slump in profits, warned of reduced market demand and announced a freeze on new projects.

A “significant” impact from building cost inflation, particularly on fixed-price contracts in affordable housing, adversely affected margins across the group during the year to May 31.

The Elgin-based firm said pre-tax profits sank by 22% to £15. 3 million on sales that were down by 29% at £332.1m. Operating profits fell by 7% year-on-year, to £20m.

Shares crashed more than 17% at one stage, to 50p, wiping more than £12m off the Alternative Investment Market-listed company’s market value. The stock made a partial recovery to 54.5p by the market close, but was still nearly 10% off Tuesday’s final price.

Springfield builds homes Scotland-wide

The group builds homes in Aberdeen, Aberdeenshire and Moray, as well as on Tayside and in Fife and the central belt. Current developments include Drakies in Inverness, Glassgreen Village in Elgin and Dykes of Gray in Dundee.

In an update on current trading, Springfield highlighted “significantly lower” levels of reservations in private housing. This is due to demand being impacted by continued high interest rates, mortgage affordability and reduced homebuyer confidence, it said.

The company does not expect these conditions to “materially improve” before spring 2024.

Meanwhile, it has secured a new loan worth £18m, as well as a 12-month extension to its overdraft facility in order to “ensure sufficient headroom in the short-term”.

Sringfield built record number of new homes in 2021-23 despite market woes

But Springfield also confirmed a record year for completions. These increased to 1,301 during the year to May 31, from 242 in 2021-22.

And Innes Smith, the firm’s chief executive, insisted the “fundamentals” of the market in Scotland were “extremely positive”.

This is fuelling confidence over mediam and long-term prospects, he said.

He added: “With Scotland one of the few places across the UK where it is still cheaper to buy than rent a home privately, affordability for home buyers is favourable. Plus, with house prices across Scottish regions holding strong, the market here has proven to be far more resilient than elsewhere.

“We are pleased to see mortgage rates begin to normalise for our customers and look forward to experiencing re-energised customer demand when buyers seize this good time to buy. We will build homes as they are reserved to react to levels of demand.”

The record sales were driven by full-year contributions from Inverness-based Tulloch Homes and central belt business Mactaggart & Mickel Homes (MMH), acquired in late 2021 and 2022 respectively.

Higher value MMH properties helped push up the average selling price.

Pause on recruitment among the steps taken to shore up Springfield’s balance sheet

But the company said it faced “challenging” market conditions.

“Decisive action” was taken to mitigate the impact of these across the business, resulting in annualised cost savings of £4m, which will benefit the group in 2023-24m, Springfield added.

Land buying activity was reduced and a land sale of £3.7m was completed. Recruitment was paused and staffing levels reduced in areas most impacted by the market downturn.

Springfield also paused entering long-term fixed price contracts for affordable homes.

But it has recently started “engaging with providers” after the Scottish Government raised key investment benchmarks for the sector. Meanwhile, Springfield’s plans for building homes in the private rented sector are still on hold because of government rent controls.

We are pausing all speculative private housing development.”

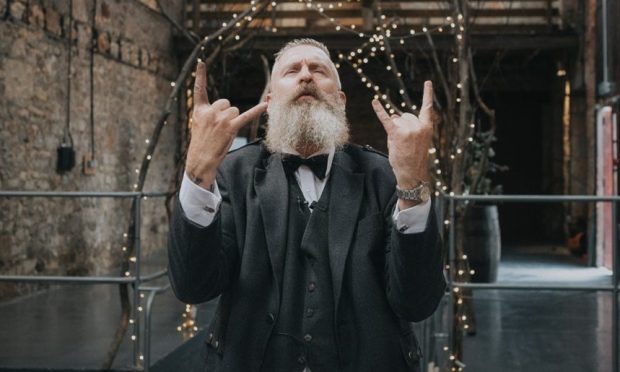

Innes Smith, chief executive, Springfield Properties

Mr Smith said: ” Our priority is to maximise cash generation to reduce our debt to ensure we maintain the value of our business. Accordingly, we are pausing all speculative private housing development. We will build based on sales and not sell based on build.

“We are actively pursuing land sales and will further reduce our cost base where necessary. We are also encouraged by the negotiations we are now having in affordable housing, which has strong cash flow dynamics.”

Conversation