Shares in famous shipbuilder Harland & Wolff (H&W) plunged by nearly one-third today after a report claimed it may miss out on a lifeline £200 million taxpayer-backed support package.

The shares regained some lost ground, closing nearly 15% lower at 10.02p.

The whole company is now worth less than £18m.

Belfast-based H&W has shipyards in Methil, Fife, and at Arnish, on Lewis.

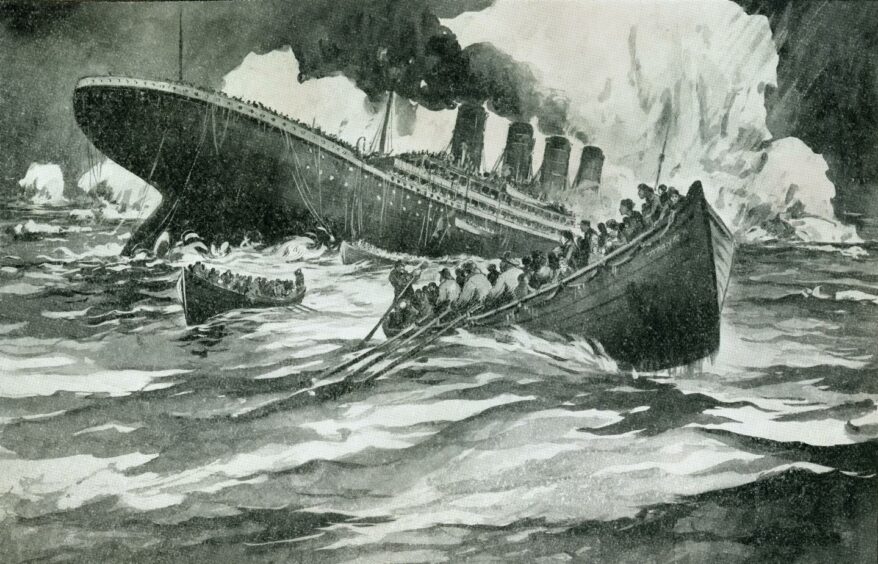

The firm is best known for building the Titanic.

Current projects include a £1.6 billion contract to build Royal Navy ships.

Harland & Wolff expects to create 400 new jobs in Methil

Just a few weeks ago the company said it expects to create at least 200 new jobs at Arnish and 400 in Methil through a £270m investment in its two Scottish shipyards.

Today’s share price crash followed a report in The Times, which warned the business may fold. Citing a defence source, the newspaper claimed Chancellor Jeremy Hunt may block a £200m loan guarantee from Westminster-backed UK Export Finance (UKEF).

This contradicted a UK Government spokesman and the company itself, which both insisted discussions were ongoing.

The Times also reported a source told it there is a “row” between government departments over H&W’s export development guarantee (EDG) application.

H&W warned last September it needed UKEF’s support to refinance a credit facility.

It added: “Should the company not be successful in raising these additional funds and continues to retain its current cost base, a material uncertainty exists that may cast significant doubt on the group’s ability to continue as a going concern.”

Auditors included the “material uncertainty” in their opinion of the group’s accounts for 2022.

As of June 30 2023, H&W’s net debt stood at £88.3m. This was after a loan from Riverstone Credit ballooned from £28m to £79m.

In its half-year report, H&W said: “Having completed significant due diligence in the first half of 2023, we are now in the process of negotiating with the high-street banks and Astra Asset Management to structure a syndicate of commercial and private debt, along with the UKEF guarantee.”

The company hoped to seal the deal before the end of last year.

Responding to The Times report, H&W said it wished to “provide clarity on, what it considers to be, a misleading and inaccurate article… and to reassure shareholders”.

The firm added: “Management remain comfortable with progress on what is a complex and large transaction for all parties involved. A further update will be provided in the next few weeks.

“The company has been working through its five-year plan, which has seen four shipyards and fabrication facilities rebuilt or refurbished, a pipeline of contracted work secured and increasing amounts of work delivered.”

H&W has £200m revenue target for 2024

H&W said its five-year plan would see it hit annual revenue of £200m by the end of 2024, of which about 90% was already contracted.

The company employs more than 1,500 people who are “all engaged on active projects”.

H&W said its next target was to increase contracted revenues for 2025 and beyond.

Before then, it aims to achieve a “milestone” break-even point in annualised earnings before interest, taxes, depreciation and amortisation.

H&W added: “The company is busy across its five markets, with substantial growth on its key energy and cruise contracts.”

The shipbuilder also highlighted “highly supportive financial partners and shareholders who are aware of the long-term plan”.

Shipbuilder ‘disappointed’ by report

In a further criticism of The Times report, H&W chief executive John Wood said: “We were disappointed to read this article and the reaction it has caused, given that we have grown the business to become a major player in the UK shipbuilding sector, whilst spreading our risk over multiple markets.

“Our EDG application has not been rejected and continues to be work in progress. I expect to be providing a fuller update on our refinancing plans in the next few weeks.”

H&W’s two Scottish sites have both advanced to the next stage of a key route to public and private sector partnership funding.

It is hoped the Scottish Offshore Wind Energy Council Strategic Investment Model programme will deliver major infrastructure upgrades.

According to H&W, support through the scheme will significantly boost its ability to service and maintain a “burgeoning” renewable energy sector.

Conversation