A Dundee fintech start-up is seeking funding of £250,000 for its platform to help small businesses get paid quicker.

Affivo is the brainchild of University of Dundee graduate Zaki Hasan, who has spent a decade working within financial services.

After a career in London, he returned to Dundee in 2023 and started to develop his app.

He believes it has the potential to be a £50 million a year business with 50 staff within five years.

How does Affivo work?

Late payment of invoices is a frequent concern for small businesses. It is not uncommon for payment terms to be 30 or 45 days – but some SMEs need funds quicker than that.

Zaki said: “My family owns a small business in India, so I know perfectly well that late payments can really be a nerve-wracking experience.

“The terms for payment to a customer might be as long as 45 days, but a lot of small businesses can’t wait that long for payment.”

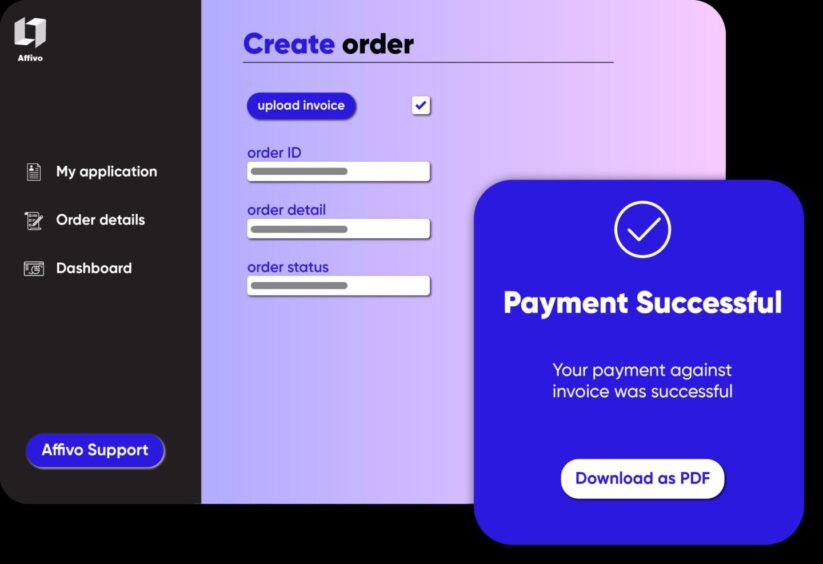

Through Affivo businesses will be able to submit invoices they have generated for completed work.

After doing a risk check, it will pay the invoice the following day, while taking a 1% to 1.5% commission.

Zaki explains: “We are basically removing friction from this process. We also then take on the risk of non-payment. We’ve built into our business model the risk that between 5% and 7% of the invoices might not be paid.”

What makes Affivo different?

There is a wide range of financial organisations who offer invoice discounting facilities. Zaki said a point of differentiation will be its ability to accept lower-value invoices.

Affivo, which is a combination of the words affinity and invoices, also plans to offer other financial insights to clients.

Zaki said: “Other invoice discounting companies exist but they mostly are focused on invoices for large amounts like £400,000 or £500,000 or above.

“We are keen to tap into the SME market, with maybe an average invoice of £20,000 to £50,000.

“Also, we see this element as just one part of what we’ll do. We can provide additional insights to drive business planning. We want to become a one-stop shop for SME financing and planning.”

Fundraising for growth

The platform is currently at a testing phase with local businesses using it to generate invoices and manage payments.

There are currently five members of staff in the business ranging from engineering, to sales, to data science.

The £250,000 fundraising campaign will see the expansion of the team and further development of the product.

It will then need more financial backing to start providing the invoice discount facility. Zaki anticipates reaching this stage in the next 18 months.

Zaki said: “There’s a lot of work to do – it’s all about gathering momentum for the product.

“The five-year plan is to scale this to a level where there are around 50 people employed, which could mean a turnover of around £50m.

“Our initial focus will be on serving small Scottish companies and there will be strong growth every year.

“We will provide high quality jobs and continue to be based in Scotland.”

Conversation