Unsecured creditors owed more than £2.6 million from a Dundee company’s collapse will share just £31,000.

It is almost two years since textile firm Bonar Yarns Limited went into administration, blaming “unsustainable cash flow issues”.

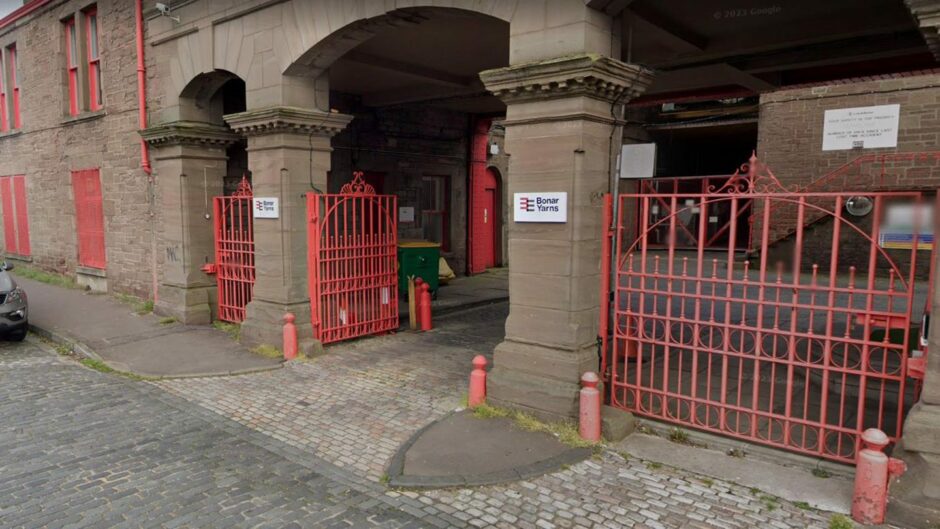

The business manufactured yarn for carpets and artificial grass from Caldrum Works in St Salvador Street.

Incorporated in 1914, the company was acquired from Low & Bonar by a management buyout in June 2020.

It reported small profits in 2021 and 2022 before the cash flow issues were identified in February 2023. Administrators were appointed on March 31 2023.

Around 60 jobs were saved for a short time when the administrators sold the business and assets to Newman Yarns Limited on April 19.

However, in October 2023, the new owner closed the factory.

Bonar Yarns’ millions of pounds of debt

Since being appointed in March 2023, the administrators from FRP have been trying to maximise the assets and establish the debts in Bonar Yarns Limited.

The sale of the business to NYL raised £251,200. However, there are multi-million-pound debts in the business.

Close Brothers, who supplied invoice financing, are due £851,000 and have a floating charge over the assets.

The sum due to HMRC is just over £49,000 while claims from unsecured creditors total £2,632,153.

A document signed by the administrators last week confirms there will be no dividend to unsecured creditors other than through the ‘prescribed part’.

The prescribed part is a share of sums raised to go to creditors rather than the floating charge holder.

In this case, it is estimated the value of the sums raised to go towards unsecured creditors will be £30,935 before distribution costs.

Preferential creditors, which are employees’ unpaid pension contributions totalling £5,827, will be paid in full.

Secondary preferential creditors, the £49,116 due to HMRC, will also be paid in full.

The administration is due to end on March 31, and an extension is not expected.

Newman Yarns era short lived

The Bonar Yarns business was bought from administration by one of its customers. John Newman, owner of Elite Turf USA, a distributor of synthetic sports turf, set up Newman Yarns Limited to acquire the assets, including the property.

However, it wasn’t long before the new owner raised concerns with staff. By the end of May 2023 – around six weeks after taking over – it said the company was to be liquidated.

Workers were told the firm would be unable to produce its products at a competitive price unless energy costs reduced.

There was a reprieve when a new deal was struck with energy providers.

However, in October 2023, liquidators were appointed.

The Newman Yarns workers won an employment tribunal last summer over a lack of notice for their dismissal.

Conversation