Administrators establishing the debts of The Buffalo Farm in Fife have received more claims from unsecured creditors.

It is a year since The Buffalo Farm Limited entered administration.

Founder Steve Mitchell acquired most of the company’s assets from administrators.

Meanwhile businesses owed debts and investors into a 2022 fundraising scheme which raised almost £1 million have been left high and dry.

The business at Bankhead Farm, Wester Bogie, Kirkcaldy changed its name to TBF Realisations Ltd last May.

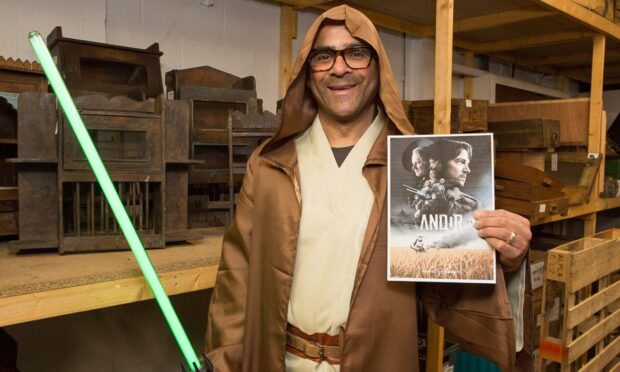

Steve Mitchell negotiating on land and buildings

A new report from administrators at FRP said they cannot complete the administration as Mr Mitchell’s new company Buffalo Produce is still negotiating with a bank for the land and buildings.

Last week, The Courier revealed the administration has been extended for a further 12 months.

The new progress report states: “The company owned the land and buildings forming and known as The Dairy Factory and Buffalo Parlour. Allica Bank holds a security over the land and buildings.

“As part of the sale of the business, Buffalo Produce sought to novate the mortgage agreement in full and acquire the land and buildings. A licence to occupy was granted to Buffalo Produce whilst negotiations took place.

“The licence to occupy has expired without an agreement between Buffalo Produce and Allica being reached.

“Discussions are ongoing and the joint administrators are assisting with this process.

“Until this matter is resolved, the joint administrators are unable to bring the administration to a close.”

The debt owed to the bank is approximately £600,000.

More Buffalo Farm debts

Meanwhile, more debts have emerged in the past six months of the administration.

Claims from unsecured creditors, which include debts to other businesses as well as investors into the fundraising scheme, now total £1.5m. This is an increase of £268,700 in the past six months.

HMRC, which ranks as a secondary preferential creditor, has submitted a claim for £581,200.

The 2022 fundraising scheme saw people invest between £1,000 and £10,000 into the business.

Perks included £100 a month to spend in the farm shop and naming buffalo in the herd.

Sums raised from hundreds of private investors totalled almost £1m.

The administrators do not expect to make any dividends to these unsecured creditors.

Mr Mitchell’s new company, Buffalo Produce, paid £45,000 for the company’s assets. Employees were transferred to the new entity. Another £35,000 was paid to acquire the book of debts owed to The Buffalo Farm from customers.

Mr Mitchell previously said the decision to start a new company with The Buffalo Farm assets was the “morally” right thing to do.

Conversation