Private schools in Scotland are able to register as charities and attract certain benefits, including Gift Aid on donations.

Charitable status means they cannot operate for profit and they must be able to show they are creating public benefit.

Independent schools register as charities with the key objective of advancing education, but often with other purposes such as advancing health through sporting participation or advancing the arts.

To pass the charity test introduced by the Charities and Trustee Investment (Scotland) Act 2005 they must show they are exclusively charitable and provide public benefit.

To do so schools offer means-tested fee remissions and bursaries and access to their facilities.

As well as providing education to pupils – with term fees ranging from £2,752 to £13,715 – in Courier country schools – they provide public benefit in a number of ways.

For example, Kilgraston School, in Perthshire, allows its grounds to used by local groups and sports clubs. Its chapel is the local Catholic church and each year staff act as markers for the SQA and music exams.

Similar activities are undertaken at Glenalmond College, also in Perthshire, where the chapel is the Episcopal church for the local area.

Last year, 3.9% of Scotland’s schoolchildren attended an independent school, according to a census by the Scottish Council of Independent Schools.

A quarter of them received financial help and 3.1% of senior school pupils had 100% fees assistance.

Should charitable status continue?

Whether independent schools should have charitable status while state schools do not is a contentious topic.

Arguably the most important tax relief offered by charitable status – non-domestic rates relief – was removed from independent schools in April 2022.

That could see schools consider whether charitable status remains beneficial.

However, a section of the 2005 Act giving charity regulator OSCR continuing power over their assets – including buildings and land – would mean these would still have to be used for charitable purposes originally set out.

‘Unique’ level of public scrutiny

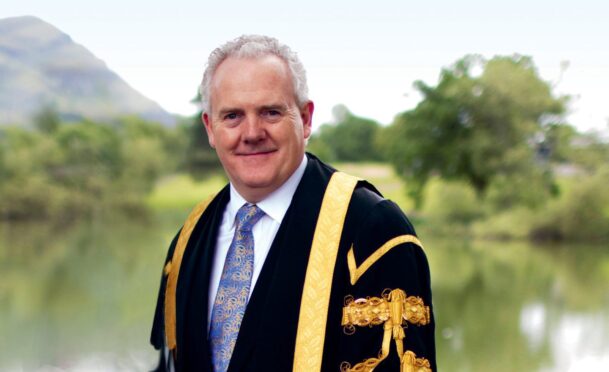

John Edward, director of the Scottish Council of Independent Schools, said independent schools account for just over 50 of 25,000 registered charities in Scotland, of which everyone could “identify ones we don’t agree with”.

He added: “Independent schools in Scotland have undergone a unique level of public scrutiny. A 2005 Act created a specific test of public benefit, which all schools are held to by the independent charity regulator.

“A further public petition to the Scottish Parliament also looked at charitable status itself.

“An act of the Scottish Parliament recently removed the (partial) rates relief provided to schools to support their public benefit activities.

“These unique measures have not been undertaken elsewhere in the UK, nor for any of the more than 25,000 other charities – of all kinds – on the Scottish register.

“That includes higher education institutions which, unlike independent schools, do receive some state funding and substantial non-domestic rates relief.

“Means-tested fee assistance to widen access is now the default in Scottish schools, and the amount available has more than tripled since the charity test first measured it, all from parental fee income.

“Any school would wish to widen participation even further if it possibly could, but increasing costs to those schools alone will not help achieve that.”

Conversation