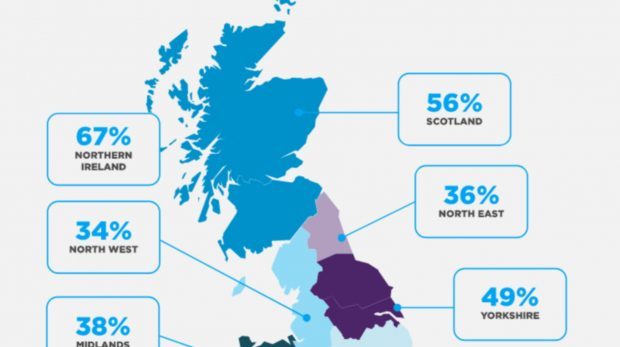

- Over half (55 per cent) of Scots don’t know what the term “interest rate” means

- Two thirds (70 per cent) can’t identify the current Bank of England base rate of 0.25 per cent

- The news comes amid speculation of a November base rate rise

With the Bank of England hinting that there may be a base rate rise as soon as the start of November, new research from MoneySuperMarket can reveal that 70 per cent of Scots can’t accurately pinpoint the current base rate.

Despite the impact a rise will have on everyday finances – including savings and mortgages – just one in 100 Scots understands how a hike of the current 0.25 per cent rate, the first in a decade, would affect their mortgage repayments.

Almost a quarter (23 per cent) of respondents said they didn’t know how it would affect their pay packet, and 41% believe their pay would not be affected at all[1].

What’s more, when asked what the term “interest rate” meant, over half (55 per cent) admit to not knowing at all, while nearly one in 10 (8 per cent) believe it is the value of how much interest their bank has in them.

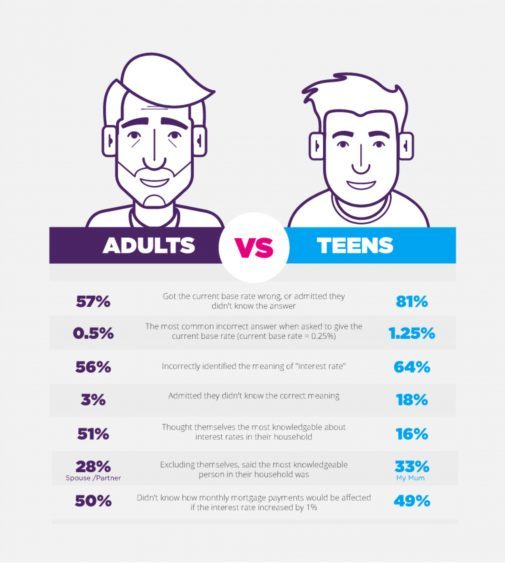

The research also uncovers a knowledge gap between generations, with a huge 81 per cent of 18-24 year olds not understanding the term ‘interest rate’, compared to just over half (57 per cent) of 45-54 year olds.

The research also uncovers a knowledge gap between generations, with a huge 81 per cent of 18-24 year olds not understanding the term ‘interest rate’, compared to just over half (57 per cent) of 45-54 year olds.

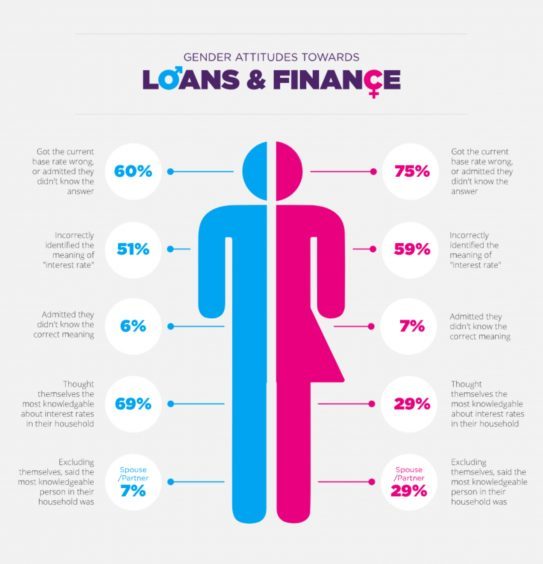

What’s more, 40 per cent of men were able to identify the current base rate compared to just a quarter of women (25 per cent). Nearly a third (32 per cent) of women admitted their partner is more knowledgeable on the topic, compared to just 7 per cent of men.

When asked who in their household was the most knowledgeable about rates as a whole, 43 per cent claimed it was themselves – yet the majority of people who answered this way (63 per cent) actually got the current rate wrong, or didn’t know it.

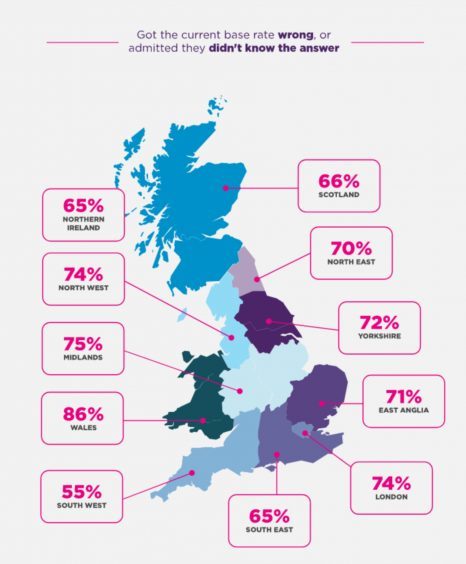

There was also a clear gap among different areas of the UK. People in the South West were the most knowledgeable, with 45% of respondents correctly stating the base rate, followed by 35% in the South East and Northern Ireland. However, only 14% of those in Wales were able to provide the right figure, the lowest of all the regions surveyed.

Sally Francis, money expert at MoneySuperMarket, commented: “There’s been very little movement in the Bank of England base rate since 2009 so it’s understandable that most Scots aren’t sure how a shift could affect their finances. The anticipated rise of 0.25 per cent might seem small but it could pave the way for a string of increases that could impact some of the biggest bills. We’re encouraging people to take control of their finances today and learn how any future changes could affect their money.

Sally Francis, money expert at MoneySuperMarket, commented: “There’s been very little movement in the Bank of England base rate since 2009 so it’s understandable that most Scots aren’t sure how a shift could affect their finances. The anticipated rise of 0.25 per cent might seem small but it could pave the way for a string of increases that could impact some of the biggest bills. We’re encouraging people to take control of their finances today and learn how any future changes could affect their money.

“A rise in the base rate, coupled with the end of the Funding for Lending scheme – a Bank of England incentive for financial institutions to borrow cheaply from it – early next year is good news for savers, but if you’re on a tracker mortgage your monthly instalments will rise as soon as any base rate increase is announced. If you’re on a capped or discount mortgage, you could also see increases so acting immediately could save you thousands in the long run, especially if base rate continues to rise. Switching to a fixed rate mortgage ensures that your monthly repayments stay the same for the duration of your fixed period, providing certainty and stability in your finances.”

You can read more information on the research here.

Base Rate Increase – what does it mean for me?

Following the first increase in the Bank of England’s base rate in over 10 years, MoneySuperMarket’s money expert Sally Francis has put together some guidance for Courier readerss who might be affected. For those with variable mortgages, the base rate rise might lead to higher monthly repayments, so here are MoneySuperMarket’s top tips:

- Cheaper mortgage – If you’re on a variable rate mortgage, you could switch to a cheaper deal. But you might incur fees and charges, so work out whether it’s really going to save you money

- Offset option – You could ask your lender about ‘offsetting’ your mortgage. This is where your savings and current account are stacked up against what you owe, and you’re only charged interest on the balance. Mortgage = £200,000, savings = £15,000 – you pay interest on £185,000

- Switch energy – If you’ve never switched provider or haven’t done so for several years, you’re probably on a standard variable rate tariff. Switching to a fixed rate deal could save you hundreds of pounds a year

- Don’t auto renew – Car and home insurers love it when you renew with them. Instead of rewarding your loyalty they often punish you with a price hike. So be a new customer every year and get the best deal in the market.

- Max your bank account – Been with the same bank for years? There’s a new breed of current account that pays interest or gives rewards for certain types of spending. And you might get a £100+ cash incentive to switch.

For more info log on to: https://www.moneysupermarket.com/store/loans/UK-unclear-how-interest-rates-work/?_ga=2.238780419.2007934736.1509442353-531159618.1507109667