Hospitality will benefit from alcohol duty being frozen, 5% VAT for the next six months, an extension of furlough and additional grant schemes following today’s budget.

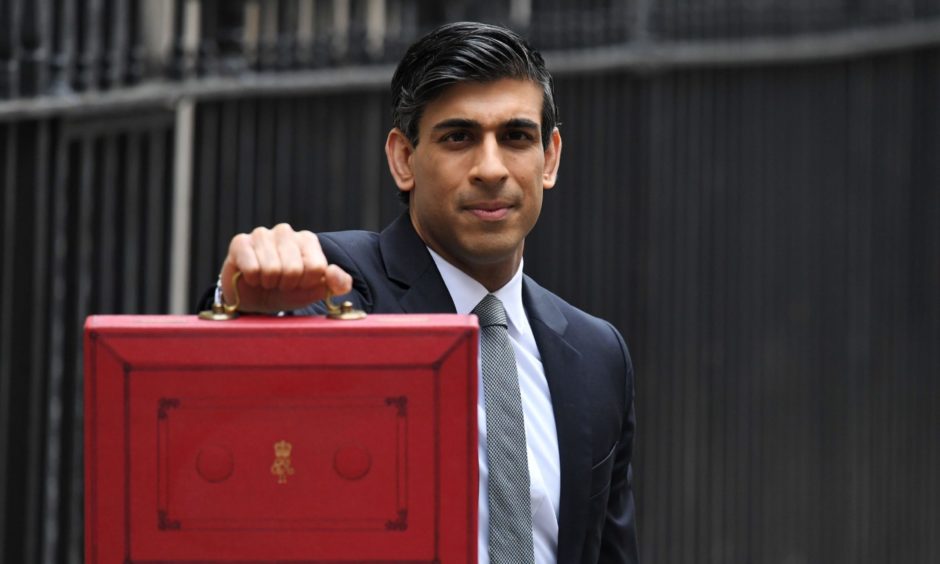

The UK Government’s Chancellor Rishi Sunak has announced that a £5 billion grant scheme will be available to hospitality firms across the UK, with businesses being able to access payments up to £18,000.

The “restart” grants will be available on a per premises basis and will be allocated based on the value of the property.

Those properties with a rateable value of £15,000 or under will receive £8,000, those valued between £15,000 and £51,000 will be entitled to £12,000, and those valued above £51,000 plus will get £18,000.

While the main £5bn is aimed at England, Scotland, Wales and Northern Ireland will receive £794 million in funding through the Barnett formula. This is on top of the £20bn already paid out.

The reduction of hospitality VAT was addressed, ensuring VAT which would usually be charged at 20%, stays at the reduced rate of 5% for an additional six months until September 30.

This move will further help assist Scottish hospitality businesses through coronavirus pandemic over the coming months.

Interim rate

An interim rate at 12.5% will be introduced after September 30 and will run for another six months until April 2022 when the standard rate of 20% will return. This will cut VAT by £5bn in 2021.

The VAT only affects those offering hot food takeaway at present, until businesses begin to reopen. VAT on cold food is zero-rated.

With First Minister Nicola Sturgeon announcing last month that hospitality was unlikely to reopen before April 26 in Scotland, this will be welcome news for businesses who were worried and left facing financial turmoil.

The chancellor also announced in his address to Parliament that alcohol duty on beer, cider, spirits and wine will be frozen for the second year in a row to help boost pub and restaurant sales when these venues finally reopen.

He also confirmed an extension to the furlough scheme until the end of September.

No changes will be made to the scheme until businesses reopen. In July a small contribution of 10% will be necessary from employers and 20% in August and September.

It is not certain whether this will affect hospitality Scottish businesses due to the sector not having firm reopening dates.

Welcome news

Manny Baber, general manager of Sleeperz Hotels Dundee and chairman of the Dundee & Angus Visitor Accommodation Association, said while the reduction on VAT continuing announced in the budget is good news, more needs to be done to help a business battered during the global pandemic.

He said: “News of an extension to VAT cuts for hospitality businesses is welcome but I’d like to see the Chancellor go further and extend it for another year.

“Hospitality has been hit especially hard by this pandemic and hotel operators need continued support to rebuild effectively.

“Business rates holidays and VAT at 5% for another year is essential if we are to return to profitability and begin to pay down the sizeable loans taken out while accommodations have been closed.

“Nor is it fair to pass price hikes onto the British public, desperate for staycations and social reunions this summer but that is surely unavoidable if government returns VAT to its previous rate of 20%.

“The extension of the furlough scheme until the end of September is also a vital support mechanism and fundamental to protecting jobs in hospitality, an industry which contributed £133.5bn to the UK economy in 2019 and accounts for almost 10% of UK employment.”

Long-term help required

Andrew McDonald, director of Andreou’s Bistro in Arbroath said that, while the announcement on furlough extension and continued VAT reduction is indeed welcome, businesses in the hospitality industry need long-term help to recover from the damage inflicted by the Covid-19 pandemic.

“It is preferable for me for furlough to be extended. We definitely need support long-term as we have been closed for pretty much most of the year so, for me, it is a necessity for it to be extended,” he said.

And with 11 staff currently furloughed because he can only offer takeaways at the present time, without the scheme, he would be forced to make lay-offs.

Andrew added: “All my staff are either on full-time furlough or part-time furlough so if restrictions were still in place long term I will need to keep people on furlough.

“If there were restrictions and furlough wasn’t available from the government then I’d probably have to make reductions in staff numbers, so that’s what it is.

“If we are able to open as normal, then I won’t need furlough. It just depends on how we can open. We need some sort of help in terms of wages if restrictions are still in place.

“Being extended until September gives us an opportunity to try and return to normality over the summer.”

VAT being continued at the lower level is welcome, too, but Andrew believes more could be done to add to measures announced in the budget.

“An extension of the VAT at 5% is vital and I would like to see it extended longer term. I think it’s pretty important to be honest,” he said.

“Everyone feels the same, restaurants and bars still need help. Ideally, people in bars and pubs would like a reduction of VAT on alcohol as that has not changed, it’s still 20% so the reduction only helps food sales.

“It is a help, but there is more that could be done but I don’t think they are likely to reduce VAT on alcohol.”

“Massive”

Lee Deans of Deans Restaurant in Perth was delighted to see the furlough scheme continue, as it has ensured he has not had to let any of his employees go.

“It is a massive thing for us. It has been massive up until now. It means that we’ve managed to retain all of our members of staff since March last year. We haven’t lost anyone and kept everyone in a job.

“It’s great to have but we just don’t know what it’s going to be like when we reopen. It will probably be a good couple of weeks and then maybe a steady uptake as things begin to get back to where you were before with the levels of business.

“It gives you a little bit of confidence when you reopen if it is a little slow and the footfall kind of isn’t there that the furlough scheme is going to be there to be able use as and when required to get you back to the point where you were before.”

The continued reduction in VAT at 5% was welcomed by Lee, as it has already been extremely helpful for him during lockdown.

“Again, VAT is massive, not only for when you reopen, all this Brexit and things as well has put costs on produce so that 15% is huge.

“It has also been beneficial when we have been closed as we have been doing a hot takeaway service which is normally 20% VAT and that has made it worthwhile doing as the numbers are quite tight. It means you can be competitive and pass that discount back on to the customer as well

“I think it’s needed, especially in hospitality. When you reopen it’s going to be a different landscape. Footfall could be down as there are fewer shops and there may be a little apprehension still and less people about, certainly initially until we get the all clear and everyone has been vaccinated and feels safe going out.

“I think to be honest from our sector I don’t know if they could have done anymore. We have been lucky that they have done as much as they have for the hospitality sector. We will never know how many survived because of it, but without it what would the landscape would be?”

Hidden costs

In Stonehaven, Aberdeenshire, Robert Lindsay, owner of beer firm and beer bars six°north, and The Marine Hotel, was disheartened by the budget news.

With Scottish hospitality closed for now and the furlough scheme also putting pressure on business owners, Robert, who has bars in Aberdeen, Glasgow, Dundee and Edinburgh says it is hidden costs like pension and national insurance that seem to be forgotten.

He added: “The employer will start to pay and if we’re not open by the Scottish Government then that will obviously cause us issues. The furlough scheme is national and without the individual businesses being allowed to trade then staff will continue to be on furlough.

“The 20% that employers will have to pay by August/September, what is missed is the National Insurance and pension schemes that we also contribute to so employers will be contributing over 30% by that point for a business which will be operating on a reduced capacity more than likely.

“Alcohol duty is a huge portion of the price of beer from a brewer and a bars’ perspective. It would have been good if that could have been reduced, but unfortunately they can’t be seen to be going against the health lobby, which doesn’t help a huge part of the UK’s economy.

“The 5% VAT is only on food sales and if you are a wet-led pub then, tough luck. It is 12.5% until April after the next six months. Bars and restaurants have been squeezed and there were calls for VAT reductions before the pandemic.

“The consumer doesn’t understand that the business doesn’t pay VAT on food purchases, but we’re collecting VAT from the customer and passing it on. The actual sale price you see on your bill is not the price the business gets as they just have to give 20% of that to the government. It appears it will just go back to normal come April 2022.

“Unfortunately breweries haven’t been eligible for rates relief as they’ve been seen as potentially being able to operate. There has been one recent grant funding been given from the Scottish Government, which, whilst is helpful, it wouldn’t cover your rent of a property for the year never mind your rates. Breweries have been operating in an environment where most of their customers have been closed but without assistance, albeit furlough when staff were furloughed.

“However, saying that, without the UK and Scottish Government’s assistance none of us would be here.”

“Missed opportunity”

Graham Bucknall of TBC Pub Company, which has The Bridge Inn at Ratho and The Ship Inn at Elie in its portfolio, said the chancellor could have taken the chance to reform VAT.

He continued: “A missed opportunity for VAT reform. As an industry we’ve been campaigning for years for more fairness in VAT, to bring us in line with the low rates enjoyed by supermarkets in the UK and by hospitality businesses in Europe. It took a pandemic to get rates to that level.

“Disappointing now to see that rates will be put back to the former high levels with no attempt to look at the benefits to the UK economy from maintaining low rates for UK hospitality businesses.”

Mr Bucknall also believes that there could be consequences when business rates return to normal levels.

“By April next year we will be back to pre-Covid rates, with an opportunity missed to look at reform to the business rates system,” he added.

“Shops, pubs, hotels and many other small businesses pay business rates – whilst online businesses like Amazon pay a tiny amount of business rates.

“Even before the pandemic, the high streets of Scotland and the UK were in dire straits, and with many more shops and pubs closing in the past 12 months there will be even fewer businesses to carry the burden of rates which pay for council services. A great opportunity to reform this outdated and discredited system has been missed.”

Regarding VAT, Mr Bucknall said it was a missed opportunity to show genuine understanding for the current situation in hospitality.

He added: “VAT rates increasing from June, employers shouldering an increasing share of furlough costs from June, an uncertain business rate environment after June – this budget seems based on an industry which is up and running and already growing. But in reality we are not open, and we have no real detail about when we will be able to be open. So we can’t quantify any benefit if we are not allowed to trade.

“So ultimately the fact that there is no duty increase on beers, on wine, on spirits – this would normally raise a cheer in our pubs and bars and across the industry. Sadly, today, it will just be met with silence, as our doors remain closed and our staff and our customers remain at home without any source of immediate hope.”

Gratitude

Sophie Latinis of Pittenweem Chocolate Company in Fife, said that the measures could be key to the business staying alive.

“We are very grateful for the support we have received as they are a lifeline to our survival and continuation,” she said.

“I am very positive for the future and my big hope for the hospitality Industry is an adaptation of the fairer EU system, where 6-7% is charged.

“Because we have not been open long enough to generate income to start the repayment of the Business Interruption Loan, I had hoped it would have been extended.”

Plusses and minuses

Also in Fife, Will Docker of Balgove Larder, was happy to see the furlough extension and VAT reduction continued, commenting: “I was pleased to have confirmation of the extension to the furlough scheme confirmed and today’s announcement offers a few other areas of support.

“It’s also good to see the extension to the reduced VAT rate for hospitality businesses – though this is very limited with most hospitality businesses being closed at the moment, this only affects those offering hot takeaway options – zero income multiplied by 5% is still zero!

“The business rate relief is also so welcome to start rebuilding this wonderful industry.

“We absolutely understand the enormity of the level of government support during these unprecedented times and that these measures have to be balanced to a shift towards government income though we are not out of this yet.

“The corporation tax increase to 25% for businesses with profits above £250,000 is an interesting move but doesn’t go far enough towards taxation of the online giants that stand to continue eroding the high street and traditional retail. This imbalance needs to be addressed to ensure the very fabric of British independent retail is preserved.

“We’re really grateful for the support we’ve seen from the government so far. The reduced VAT rate in particular has been been a lifesaver for us – really our saving grace. We’ve largely operated as a takeaway only from our two restaurants and while we’ve been able to use the furlough scheme, other business costs still have to be paid – so we’re really pleased to see the extension of the reduced VAT rate as well as the furlough scheme reduction.”

‘Fourth winter’

Marco Truffelli, partner and managing director, Rufflets St Andrews, said a longer extension of VAT relief would have been more welcome.

“Due to Covid-19, the hospitality sector will go through its ‘fourth winter’ after a very short (2021) Summer. While the VAT cut to 5% is welcomed, in reality, it will only be applied to three full months and it would have had a greater positive impact if continued at 5% until March 2022,” he said.

Hearing that businesses with profits of £50,000 or less, around 70% of actively trading companies, will continue to be taxed at 19% and a taper above £50,000 will be introduced so that only businesses with profits greater than £250,000 will be taxed at the full 25% rate, Mr Truffelli added: “My very personal view is that, somehow the consequences of the pandemic have to be paid for sooner rather than later and not left to be entirely picked up by our children or grandchildren. Indeed, greater taxes are never welcomed but necessary. The proposal seems sensible and, coupled with the ‘super-deduction’ quite astute.”

He also welcomed alcohol duties being frozen across the board for the second year running, commenting: “This is highly welcomed, as the hospitality sector will be in a better position to help consumers to celebrate a return to normality!”

And Mr Truffelli hopes that the Scottish Government puts any additional monies it receives to work for the good of the country.

He said: “The business rates in Scotland are determined by the devolved government and we hope that with the extra £1.2bn received in this budget by the devolved administration, it will be put to good use to assist and stimulate the tourism and hospitality sectors, among the ones most in need.”