The MoD has admitted it will “closely monitor” the impact of Scottish Government tax changes which it has been claimed could penalise military personnel at bases north of the border, including Arbroath’s 45 Commando.

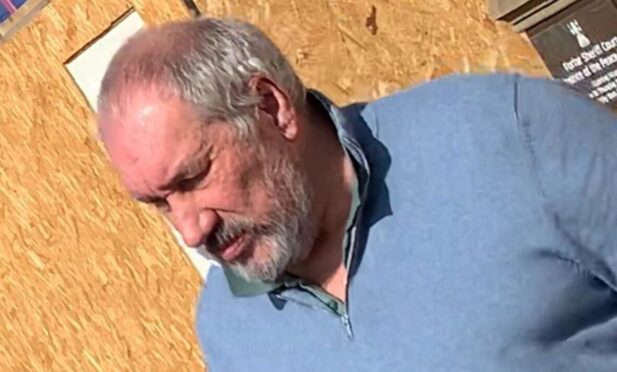

An Angus councillor has described the prospect of an Arbroath Royal Marine paying more tax than his Plymouth counterpart as “appalling and deeply unfair” – branding it ‘a minefield’.

Angus MP Kirstene Hair has asked for Westminster intervention over the changes after it emerged military personnel based in Scotland, who earn more than £33,000, will face higher tax bills than their counterparts based in England.

The Scottish Government previously announced the introduction of two new tax bands and increases to existing tax rates, which will affect personnel stationed at Scottish military bases, including the Angus home of the elite Royal Marines unit.

Ms Hair raised what she described as the ‘unfairness’ of the situation on the 10,000 armed forces staff stationed in Scotland at a meeting with the Secretary of State for Defence, Gavin Williamson.

She has also asked the leader of the House of Commons, Andrea Leadsom, what analysis is being undertaken about the possible impact of what she described as a ‘tax hike’.

Mrs Leadsom said: “Over the coming months, the MoD will be reviewing the impact of this latest decision by the Scottish Government.

“All those who are identified as Scottish taxpayers by HMRC will continue to be issued with the appropriate tax code and so must have Scottish income tax applied to their earnings.”

Ms Hair concluded: “The situation is untenable and I have called on the UK Government to step in and clear up the mess the SNP have created.

“This SNP Government needs to get to grips with the significant impact these changes are having on brave servicemen and women who so selflessly service our country.’’

Arbroath councillor David Fairweather said: “When anyone signs up to serve in any branch of the armed forces, they do so in the knowledge that they will be serving the whole of the UK.

“I think it is appalling that we are now facing the situation that someone serving at Condor, or any other military base in Scotland, could be financially penalised compared to their colleagues serving in other parts of the UK.

“Most people can make the choice whether they wish to live in a higher tax environment, but this is not the case for military personnel.

“It is deeply unfair that, for example, a Royal Marine in Arbroath ends up receiving lower pay than his equivalent based in Plymouth.

“To that end, I would urge the Scottish and UK Governments to work together and ensure that there is no pay discrimination for serving personnel.”

An MOD spokesperson said: “We realise the importance of this decision to service personnel and their families and we continue to closely monitor the impact on our workforce.”

A Scottish Government spokesman said: “The new starter rate we are proposing, combined with an increase in the personal allowance, will result in 70% of all income taxpayers paying less tax than they do this year for a given wage and 55% of Scottish income taxpayers will pay less tax than people earning the same amount and living in the rest of the UK in 2018-19.

“We are fully committed to supporting the armed forces community. Service provision varies in different parts of the UK and Scotland continues to be an attractive place to live, work and do business with access to many services not available elsewhere in the UK such as free school meals, personal care, prescriptions and eye tests, and university tuition when they are ordinarily resident.

“The definition of who is a Scottish taxpayer is set out in UK legislation and is a matter for HMRC.”