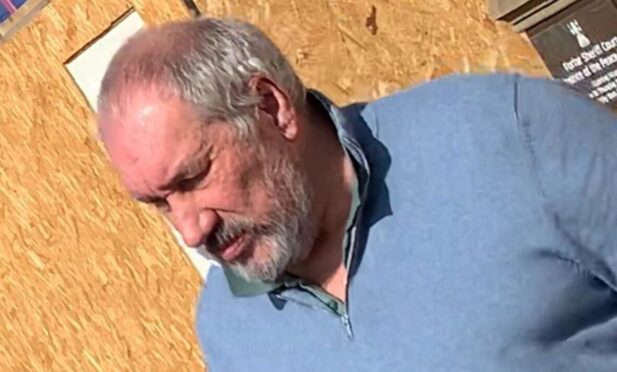

A former Dundee banker who conned a vulnerable customer with dementia out of almost £18,000 has been jailed.

Stephen Barr admitted deliberately targeting 81-year-old Douglas Crumley in a desperate effort to clear his own debts.

Mr Crumley – who has since died – was targeted at the Bank of Scotland by ex-link manager Barr because of his confused state.

Dundee Sheriff Court heard Barr used his brother’s Nationwide bank account to obtain thousands of pounds from the pensioner.

Barr, 38, was eventually snared after investigators picked up unusual activity on the bank’s system.

Mr Crumley’s family were repaid the money but the bank has still not been reimbursed.

“This is so serious that there is no appropriate alternative to a custodial sentence,” Sheriff Paul Brown told Barr on Tuesday.

The sheriff said he would reduce the jail term by 25% due to the time it has taken for the case to resolve.

Prosecutors are also aiming to claw back money via proceeds of crime legislation.

Ripped off pensioner

The court previously heard Barr began working for the Bank of Scotland in 2005 as a call centre worker, moving through the ranks and enjoying a “stellar” career.

Mr Crumley became a customer in 2015 and used a current account for his pension income and general living costs, with no third-party access to his accounts.

Prosecutor Joanne Ritchie said Barr told his brother he was in “considerable debt” in January 2018 and asked to use one of his bank accounts.

“His brother did not see this as unusual as he had approached him for loans and money many times before.

“He advised the accused that he had a Nationwide account that he was not using.”

Between March and April 2018, Mr Crumley – in the early stages of dementia – spoke with Barr at the bank’s Murraygate branch about his financial affairs.

Barr added notes to Mr Crumley’s file stating the vulnerable customer was “becoming increasingly confused” with his accounts.

Concerns were first raised in May 2018 when investigators noticed a number of “faster payments” being made by Barr from one of Mr Crumley’s accounts.

“The staff file number used to make these payments was the same account the accused received his salary into,” Ms Ritchie said.

“Douglas Crumley did not report these transactions as fraudulent; however, group investigators at Lloyds Banking Group (Bank of Scotland’s parent company) were aware that he was elderly and vulnerable and were concerned.”

Five payments totalling £10,550 were clocked as suspicious.

The court was told the Nationwide account was only 5p in credit before the first payment of £1,000 was made.

This was immediately withdrawn in cash.

A senior investigator established Barr withdrew or transferred £17,939.98 of Mr Crumley’s money between March 8 and May 15 2018.

Interview admissions

Barr was interviewed internally and claimed he was over £30,000 in debt.

Ms Ritchie said: “The accused stated Mr Crumley was a regular customer of his and he was aware he had dementia.

“He later stated he deliberately targeted Mr Crumley due to his vulnerability.

“He said he felt ‘awful’ and made mention of taking his own life.”

Barr, of Summerfield Place in Aberdeen, pled guilty to forming a fraudulent scheme at the Bank of Scotland branch on Murraygate between March and May 2018.

‘Vulnerable’

Solicitor Gary Foulis attempted to persuade Sheriff Brown to impose a “significant” community sentence on Barr, who won awards in 2022 and 2023 while working for property firm Martin and Co in Aberdeen.

Mr Foulis said: “He understands this is a significant breach of trust and I don’t try to underplay that.

“I would submit that Mr Barr definitely has to be punished and he might be someone that’s extremely vulnerable in a custodial setting.”

Barr is subject to a trust deed and is unable to pay back the bank despite having a “desire” to do so.

“He was in very difficult personal circumstances and he unfortunately couldn’t resist the temptation that was put before him,” Mr Foulis added.

“It’s something he will have to live with for the rest of his life.

“It’s had a significant impact upon not only his professional life but his personal life as well.

“He finds himself being a social outcast.

“People who were previously friends have now disowned him because of the adverse publicity.”

Sentencing

Sheriff Brown said he would have sentenced Barr to two years but reduced this to 18 months.

This was further reduced to 13 months after Barr’s guilty plea at a first diet hearing.

Helen Nisbet, Procurator Fiscal for Tayside, Central and Fife, said: “This was a shocking and callous betrayal of trust of both a vulnerable man and of an employer.

“We all should be able to rely on banking staff to deal with our money honestly. However, in this case, Stephen Barr set out to target an elderly man and steal from him.

“Thankfully, his criminal conduct was uncovered and justice has been done.”

For more local court content visit our page or join us on Facebook.