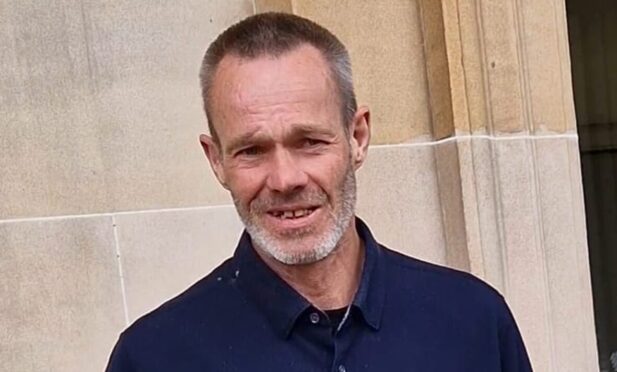

A crooked Halfords shop manager who embezzled £90,000 from company bosses to feed a lifelong gambling habit has been jailed.

Gary Ridgewell confessed to a criminal cashing-up scam while he was in charge of the retail giant’s Perth store.

He pocketed money from the till and then doctored customer coupons to balance the books.

Perth Sheriff Court heard the scheme ran for five years, starting when he was manager at the Dumbarton branch.

He was eventually caught when an internal investigation found suspicious activity at both workplaces.

Gambling since he was 13

The 50-year-old, from Doune, returned to the dock for sentencing having previously pled guilty to embezzling from the company between January 2013 and March 2018.

Sheriff Alison McKay told him: “You will appreciate that this was a significant breach of trust.

“Even if there had been restitution in this case, a custodial sentence would still have been at the front of my mind.”

First time offender Ridgewell was jailed for 30 months.

The Crown Office is also raising Proceeds of Crime action against him, to claw back the stolen amount.

Solicitor David Holmes, defending, said his client had been gambling since he was 13.

Ridgewell had taken steps to beat his addiction after he was sacked from Halfords in March 2018.

The court heard he is now on a banned list for gambling sites and can no longer place bets with them.

At the last hearing in August, Mr Holmes said his client was hoping to have gathered the money to pay back the company.

“He had hoped that he would be able to find restitution.

“People were prepared to help him with the money.

“But he realised that they would be getting themselves in debt because of something he did and he could not bear to have that on his conscience.”

Probe found suspicious activity

Ridgewell became manager at the Dumbarton branch in September 2010, and moved to Perth’s St Catherine’s Retail Park store in April 2016.

He discovered an “anomaly” when registering customer coupons.

“The accused realised that by artificially increasing the value of the coupon, the cash balance would be higher than the physical cash balance in the till,” prosecutor Callum Gordon said.

“He realised that cash could be removed from the till, without formally being withdrawn, and the total recorded balance would match the physical balance.

“He also found that if there was not enough cash in the till to facilitate the removal of cash, he could transfer money from the safe.”

The scam went unnoticed until Halfords’ fraud investigator launched an nationwide probe, sparked by a non-related issue at another branch.

As part of the inquiry, all shop managers were asked to produce a report of their safe balances.

The investigator found the Perth store had the highest balance, followed by Dumbarton because of the high number of bogus coupons Ridgewell had registered.

When questioned by employers, Ridgewell admitted the scheme and told bosses he had a gambling problem.

He was sacked following a disciplinary hearing in March 2018.

For more local court content visit our page or join us on Facebook.