The legal representative for a former Perthshire businessman who dodged thousands of pounds of tax claimed investigations into the matter are “fraught with difficulties.”

Kevin McCallum QC, who appeared at Perth Sheriff Court on Tuesday on behalf of Stuart Newing-Davis, 48, said there had been difficulties with transport arrangements so his client couldn’t be at court.

And he outlined issues concerning a house owned by Newing-Davis that his family were living in over in France that forms part of the proceeds of crime investigation.

“My client is currently serving a prison sentence at HM Castle Huntly but could not be here today,” he said.

“I am here because there are difficulties associated with a home owned by my client over in France, that Mrs Sarah Newing-Davis and the children were living in.

“The problem is that she took ill following the court case here, was hospitalised and is now in a mental health sanatorium in France. A curator been appointed to look after her affairs.

“There is outstanding default on the mortgage on this property, which was occupied by Mrs Newing-Davis when the family re-located to France.”

Mr McCallum explained that he has made contact with a solicitor in France regarding the situation with the property to get his opinion and he understood the Crown would be making their own inquiries into it.

“I am asking for time to speak to another solicitor in France and to see if any equity can be released from this property,” he added.

“However, I must say this property in France is fraught with difficulties.”

Depute Fiscal Carol Whyte revealed the Crown had received a “bundle” of documents associated with the home in France from the proceeds of crime unit in Edinburgh.

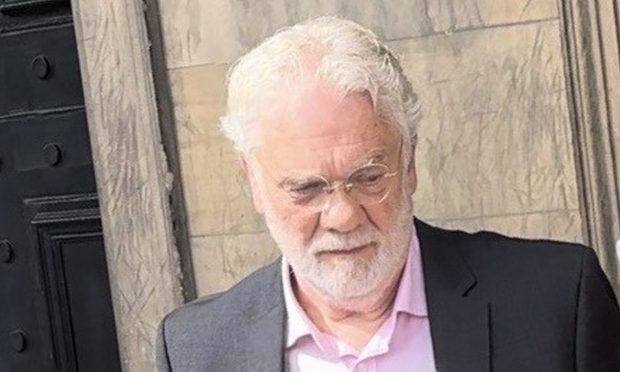

Newing-Davis had been sentenced to 32 months in jail in June at Perth Sheriff Court, after being convicted of a £174,000 VAT fraud.

He had pled guilty to five charges of fraudulently evading VAT totalling £174,179.33 while a director of Trainpeople.co.uk on dates between March 3, 2010, and June 7, 2011.

Latterly, Newing-Davis had been working as a London bus driver.

The Crown and Her Majesty’s Revenue and Customs (HMRC) aim to recoup some of the money owed by investigating his assets, including the aforementioned home in France.

Sheriff William Wood agreed to hold another proof hearing into the proceeds of crime investigation which will take place at court on February 23.