Council tax bills unpaid to Dundee City Council have reached just under £6 million, almost double what was owed four years ago.

Covid-19 and the cost of living crisis have been blamed for the rise, with many struggling to pay bills as the prices of everyday goods soar.

The number of households in arrears has also grown in the past four years, going from 7,802 to 12,454.

While the amount of money owed to the council has increased, the level of debt written off has dropped.

Figures for 2022 are incomplete, however statistics from 2021 show just under £134,000 of debt was written off – a huge fall from the £642,600 cancelled out in 2018.

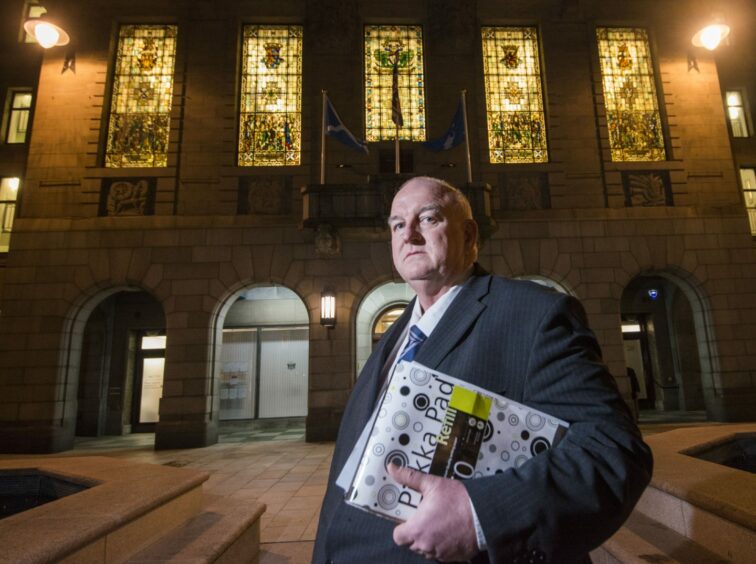

Labour group leader calls for ‘greater buffer’ as council tax debts increase

Labour group leader Kevin Keenan says questions need to be asked in light of the new figures.

He said: “It comes as no surprise given the cost of living crisis, that people are finding themselves in financial difficulties and bills such as council tax slip into arrears.

“Dundee City Council budget to collect somewhere in the region of 94/95% of council tax and it often comes in late so it is picked up the following year.”

He added: “If council tax collection has dropped off the edge, then council will need to build in a greater buffer when it sets the next budget and council tax level, which will be a further burden on all those who are paying.”

Council tax debt accounts for almost a third of advice bureau cases

The impact of council tax debt is also being felt by Dundee Citizens Advice Bureau – with almost a third of their clients struggling to pay the bill.

Director Tracy McNally said: “Council tax debt is by far the biggest debt issue that clients come to us with, with around 30% of these clients having already received notice of enforcement actions or summary warrants.

“This results in clients incurring a further charge of around 10% in addition to the debt and they can have money taken from their bank accounts or an arrestment of wages.

“Families are really struggling and we are experiencing record-breaking demands for our services as people grapple with this crisis.

“Our staff and volunteers are working really hard to help people however the demand for our services far exceed our capacity at the moment, with may clients contacting us for money advice who may have never had the need for our services before.”

Council ‘understands the financial pressures’ faced by families

Neighbouring Angus has much higher council tax arrears due to its size but its debt has only risen by just over £1m in the last four years – from £22.4m in 2018 to £23.5m in 2022.

However, in Fife, the situation is similar – with arrears rising from £7.4m to £12.9m in the past four years.

In Perth and Kinross, the amount currently owed to the council stands at £33.3m- however no data on previous years was provided to The Courier.

Dundee City Council says it is doing all it can to support struggling families as debts continue to rise.

A spokesperson said: “We understand the financial pressures individuals and families may be facing at this time.

“We therefore regularly work with debtors in order to establish an affordable repayment arrangement to receive the monies owed.

“The council recognises coping with debt can be extremely stressful and can have serious effects on the lives of individuals and families.”

Those concerned about paying their council tax can contact the council’s welfare rights team on 01382 431188.

Help is also available via the Citizens Advice Bureau or the Brooksbank Centre.

The Citizens Advice Bureau also recommends that residents check they aren’t overpaying on their council tax by calling the council or visiting https://www.checkmycounciltax.scot

Conversation