When RBS came perilously close to collapse amid global economic turmoil almost 10 years ago, it was United Kingdom taxpayers who dug deep to save the famous old bank from going crashing out of business.

While there were inevitable rumblings of discontent, many felt it was a price worth paying to save an institution that was part of the fabric of Scottish domestic and

business life.

-

Share your views on why RBS must be forced to think again by emailing news@thecourier.co.uk

On a personal level, the Royal Bank of Scotland was, after all, a part of every day dealings for so many people. It was where their parents banked and where they opened accounts for their children.

RBS, more than many banks, has benefited from generations of family support.

The loyalty shown to the bank when it could so easily have been left to wither and die was nothing short of extraordinary.

Sadly, it would appear that their loyalty is not to be repaid by the board of the bank.

Instead RBS which, lest we forget, is still largely owned by the taxpayer, is planning swingeing cuts. Branches across Scotland will close. Hundreds of jobs will be lost.

This is not a story about a big business making a hard-nosed financial decision because there is no alternative and times are tough.

The place of banks like RBS in society is different and they must act with a social conscience and not just run a slide rule over their problems.

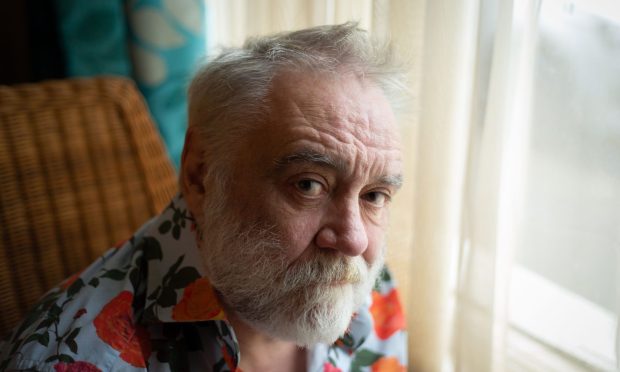

This is a story about the elderly residents of Aberfeldy, Montrose or Kinross who are to be left without a high street branch of the bank they have trusted all their life.

Unions have described the proposed cuts as “savage”.

Politicians have spoken of their horror.

Yet we need not stand by and watch this catastrophe unfold.

We can all remind RBS where it has come from – and to whom it turned when the going got tough not so very long ago.

The Courier will join its readers in fighting these proposed changes every step of the way.