Almost 400 people every week in Tayside are seeking help as they drown in a sea of unsecured debt.

Struggling residents are contacting the country’s biggest advice service because of financial difficulties as they struggle with payday loans, store cards, shopping catalogues and other debts.

Unexpected changes in personal circumstances mean that for many, their debts spiral out of control and force them to seek help.

However, experts in Angus are warning the grim figures could be just the ‘tip of the iceberg’.

Figures obtained from Citizens Advice Scotland (CAS) show that in the last three years, more than 14,000 people have sought advice from the organisation’s advisers.

But these figures do not include debts such as hire purchase arrears, council tax, rent and mobile phone bills.

So called payday loans have been particularly controversial, not just because of their high interest rates, but also the financial penalties incurred for missing payments.

One popular payday lender offers a £480 loan over nine months, with monthly repayments of £106.56, giving a total of £959.04 to be repaid at 535% APR.

Angus Citizens Advice Bureaux Manager Janice Fullerton said: “There was a time when clients would come to us with ten or twelve payday loans amongst their creditors.

“Although clients don’t have the same level of pay day loans now, overall the number of people in debt is increasing and we know that the people that come to us are just a fraction of the people who are in debt.”

“I know the impact it can have when people receive scary letters about their debts, but it is vital that people are informed about the options that are available to them so that they can find a solution so I would urge anyone whose debts are becoming a problem to get in touch.”

“We are a free, confidential and non-judgemental service who will help you make an informed choice to deal with your debts.”

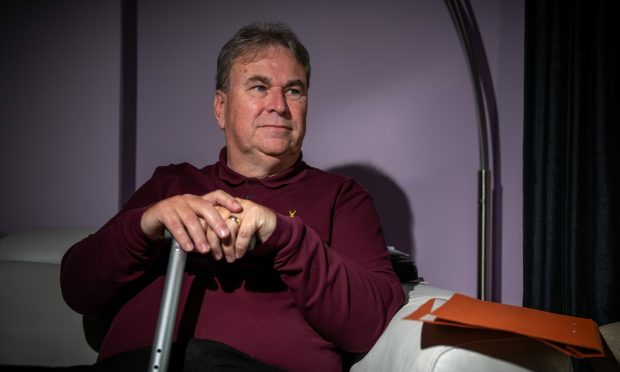

Arbroath West and Letham Independent Councillor David Fairweather said he was aware of the growing problem: “It used to be that people might get themselves into debt because of poor decisions, but it is different now.

“People are borrowing money because they have had their hours at work reduced or lost their jobs completely, and I think these figures are just the tip of the iceberg.

“In some dreadful cases, people have become seriously ill and require lengthy treatment, but are only receiving statutory sick pay and can’t honour their commitments, so they turn to short-term borrowing, or use credit cards to make ends meet.

“Citizens Advice do a fantastic job locally, and I would also urge people to ensure that they are getting all of the benefits they are entitled to by speaking either to Citizens Advice or the Welfare Rights team at the council.”

Debt advice is a key component of the advice that is offered by citizens advice bureaux.

In an era of rising consumer debt and public sector cuts, it is also an essential service for thousands of people across Scotland struggling to make ends meet.

Each of the bureau offices in Scotland help clients with their debt problems at the same time as dealing with the causes of their debt, such as benefit problems, redundancy, and/or relationship breakdown.