A Fife man claims he could lose up to £90,000 in pension payments following a Royal Bank of Scotland “error”.

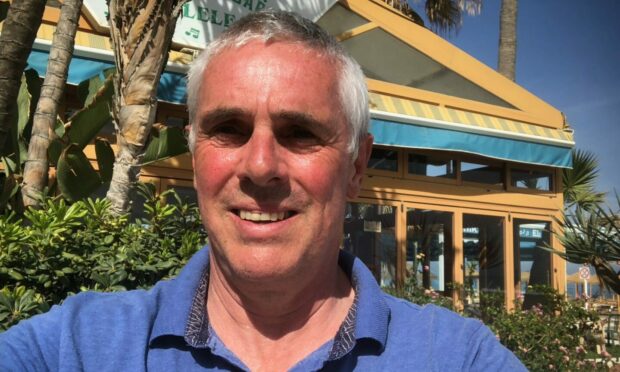

Peter Greir, from Dunfermline, is one of 8,000 former RBS staff members expected to lose out on tens of thousands of pounds due to the mistake.

The bank, part of the NatWest Group, had written to staff and pensioners over two decades stating that pensions accrued from April 1997 were guaranteed to increase by 5% per annum or by the increase in the Retail Price Index (RPI) if less.

But the bank has admitted that the “guarantee” was an error – and has lowered the cap to 3%.

Peter has now launched a petition – signed by over 1,000 people so far – calling for RBS pensioners to be “treated fairly” and to reinstate the 5% cap.

He and other angry staff have also sought legal advice, saying the financial impact is “significant”.

Some could lose more than £100k

Peter, who retired from RBS in 2017 after 20 years with the company, says he is “very concerned” about his financial prospects after learning about the error last November.

The 65-year-old said: “A lowering of the cap from 5% to 3% is not a small matter – it is a 40% reduction in this key benefit in a period of high inflation.

“This compounds hugely over, say, a 20-year retirement.”

He says that each £10,000 of annual pension affected could result in a £70,000 loss over 20 years, if inflation is over 5%.

Peter, who was the head of technology for customer contact and operations at RBS, added: “For me, over 10 years, I could lose out on £50,000, and over 20 years it will be more than £90,000.

“I have a relatively small pension with the bank compared to some people, so there are some who will lose more than £100,000.

“It will have quite an impact, especially in today’s climate, where everybody could use every penny they can get.”

It comes as the main measure of inflation, the Consumer Prices Index (CPI), soared to a 40-year high of 11.1% last year and remains above 10%.

Peter and other campaigners say the errors involve failing to update a pension deed with the correct inflation proofing rate in 1997, and at the time of NatWest integration in 2002.

They also believe there was also a failure to check the communications made to members over a period of 22 years.

The scheme trustees first wrote to the 8,000 people affected in March 2020, advising that future increases would be capped at 3%.

A spokesperson for NatWest Group Pension Fund says the 5% cap was used by trustees of the pension scheme for any increases between April 1997 and April 2020.

Bank says fund ‘provides generous guaranteed benefits’

The spokesperson said: “We did not reduce any pensions or make any attempt to recover the overpayments that were made to members once we became aware of the issue.

“Members will not have been impacted by the rules being properly applied until this April, when the annual update to pension payments was made, as inflation has not been above the 3% limit when these reviews have taken place in previous years.

“We took this action so that the rules were properly applied to ensure all members were treated fairly.

“We believe the fund continues to provide generous guaranteed benefits, with membership worth around 40% of salary a year across all remaining active members.”