A bid has been launched to stop a Fife town becoming the country’s next “banking desert”.

The Bank of Scotland recently announced it would be closing its Lochgelly branch — the last bank left in town — in February.

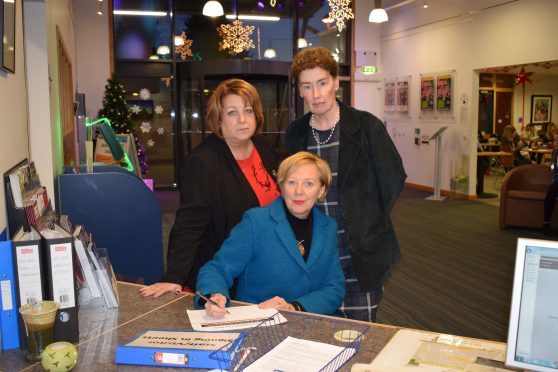

However, Lesley Laird, MP for Kirkcaldy and Cowdenbeath, joined local councillors Mary Lockhart and Linda Erskine to launch a petition calling for BOS to think again.

Urging residents to sign the petition, Mrs Laird said: “The plan to close the branch will hit elderly and vulnerable customers hard, make no mistake — not only in Lochgelly but in the neighbouring towns of Benarty and Cardenden.

“While BOS reasons that customers will only have to travel 2.2 miles away to the next available branch in Cowdenbeath, in reality some people will have to take three buses to get there; that’s an unacceptable alternative for people with mobility issues or those for whom every last penny counts.”

Mrs Laird has written to BOS requesting a meeting to discuss the Lochgelly branch and also RBS to propose a new wider banking strategy.

She said: “RBS recently closed a number of branches in my constituency and outlined to customers alternative branch banking arrangements only to subsequently close these alternative branches within a very short period of time.”

“There seems to be no wider corporate social responsibility from banks to ensure no communities are left in a ‘banking desert’, which is effectively what will happen in Lochgelly.”

She added: “Banks articulate a strong corporate social responsibility ethos, encouraging their staff to take part in many community, charity activities.

“I’ve written to BOS chief executive, António Horta-Osório, and RBS chief executive Ross McEwen appealing to them to develop a wider bank strategy which really does have the customer at its heart.

“The pace of technology banking is moving quickly — but that should not mean that communities and customers get left behind because they either can’t or don’t wish to do so.

“There are challenges with connectivity in many areas and technology solutions are not always practical.

“Branch banking provides the glue that supports many communities and small businesses across the country. What I am advocating to BOS is a more creative and collaborative approach that I believe could be taken.”

The Bank of Scotland has stressed that it took the decision to embark on the closure programme partly in response to changing customer behaviour and the declining number of transactions being made in branches.

The petition ‘Save Lochgelly’s Last Bank’ has been distributed among local shops and businesses in Lochgelly, Benarty and Cardenden.

An online version can also be found at http://www.gopetition.com/petitions/save-lochgellys-last-bank.html.