Politicians and business leaders in the Fair City reacted with dismay following the announcement Beales department store is facing administration, raising concerns it could become the “latest casualty” in Perth’s retail sector.

The chain risks collapse unless it can find a last-minute buyer, sparking job fears for the Fair City outlet and the company’s 1,000 employees across their 22 UK branches.

The store occupies one of Perth’s landmark retail buildings on St John Street, which was previously home to McEwens before it fell into administration in 2016.

Beales opened its doors in Perth in November 2017 but last month the firm hired advisers at KPMG to lead a strategic review in order to find a profitable future for the business.

Perth and Kinross Council Leader Murray Lyle said the local authority would support the company where possible, adding that it was still benefiting from rates relief for new businesses.

The Conservative councillor said: “My understanding is that they are trying to find a buyer.

“Should they come in contact we will do everything we can to support them.

“It would be a loss to Perth should it happen but I’m hopeful they will find a buyer and a resolution.”

SNP MP Pete Wishart has made contact with senior management to discuss the situation at the Perth branch.

Mr Wishart said: “I am deeply concerned to hear about the current financial situation at Beales.

“This will be a deeply worrying time for members of staff, especially considering that the Perth store has only been open for just over two years.

“There have been a number of high profile high street chains which have ceased trading in the past year and I sincerely hope that everything possible can be done to prevent Beales from becoming the latest casualty.”

The chief executive of Perthshire Chamber of Commerce, Vicki Unite, argued despite retailers facing “an extremely challenging trading environment” across the UK, Perth remained an “excellent” place for business.

Ms Unite said: “Our thoughts are with the staff of Beales locally at this time, and we hope a positive outcome can be reached for the business and its employees.

“Despite the current uncertainty, we have many local independent retailers who are thriving both in the city and across Perthshire.

“Perth and the wider region remains an excellent base for new business, with excellent connectivity, a strong quality of life and a reputation for high quality independents.”

The business leader also pointed to a newly endorsed development plan by Perth City Development Board which focuses on addressing key challenges and opportunities for the city and wider region over the next two decades.

It is understood Beale’s is hopeful a rescue deal can be secured but could still be forced to enter insolvency, while it has been reported management has also spoken with two potential buyers, including a venture capital investor and a rival retail business.

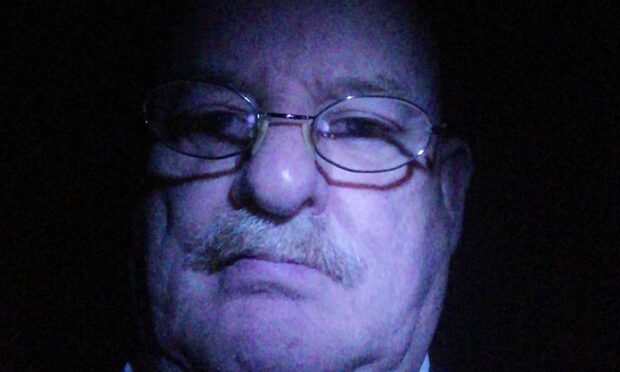

Chief executive Tony Brown told regional newspaper The Bournemouth Echo the retailer has struggled with difficult trading conditions and criticised the “lunacy” of high business rates.

He said: “We are confident that we have a solution for the business that will create a stronger if leaner Beales.

“We hope to have a stronger business at the end of the process. I can’t predict which stores will stay and which stores won’t because it all depends on landlords and local government.

“We’re going through a process and we hope to be able to restructure the business for a profitable future.”

The retailer was taken into private ownership by Mr Brown in 2018, 23 years after the company was floated on the London Stock Exchange.