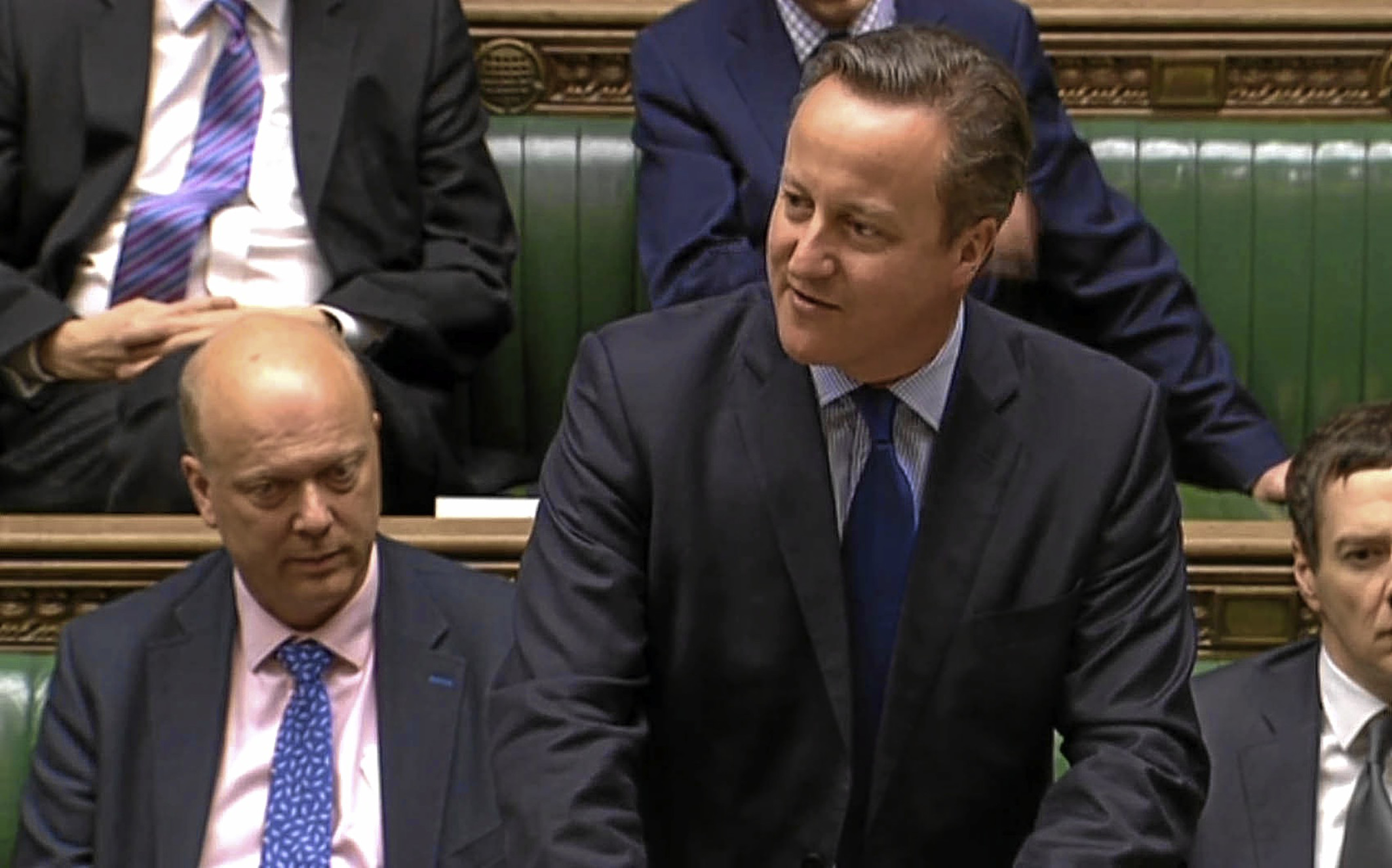

Standards watchdogs will not investigate Prime Minister David Cameron over the off-shore controversy revealed by the Panama Papers data leak.

The Parliamentary Commissioner for Standards, Kathryn Hudson, has decided not to probe the matter, but her office refused to explain the reasons for that decision.

Mr Cameron was forced into the position where he had to release a six-year summary of his tax affairs after it emerged he made a £19,000 profit from selling shares in an off-shore trust set up by his father, Ian.

The Prime Minister insisted he was not involved in a tax dodge, and the way the trust was set up was entirely proper.

But Mr Cameron did admit he had badly handled the subsequent furore after details of the business emerged in the Panama Papers leaking.

Mr Cameron said he had initially been angry about the way his father’s memory had been “traduced” as a result of the controversy.

After the political storm erupted, Mr Cameron said he was happy to provide more information about his personal finances to the Parliamentary Standards Commissioner if required.

Mr Cameron said he sold his shares in the off-shore trust Blairmore Holdings in January 2010, five months before becoming PM, because he wanted to avoid any conflict of interest.

“I did not want anyone to be able to suggest that as prime minister I had any other agendas or vested interests. Selling all my shares was the simplest and clearest way that I could do that,” Mr Cameron told the Commons at the beginning of last week.

The Prime Minister said at the time he had given information on the affair to the Parliamentary Standards Commissioner.

“There are strict rules in this House for the registration of shareholdings – I have followed them in full,” he told MPs.

“The Labour Party has said it would refer me to the Commissioner for Parliamentary Standards – I have already given her the relevant information and if there is more she believes that I should say I am very happy to say it.”

Mr Cameron also faced questioning over a £200,000 gift from his mother, which followed the £300,000 inheritance he received after the 2010 death of his father Ian.

The payments by Mary Cameron to her son in May and July 2011 were given tax free, and will only become liable to inheritance tax of up to 40% if the Prime Minister’s mother dies within seven years of handing over the money. There is no suggestion that they have broken any rules.

Mr Cameron said parents should not be embarrassed about passing money on to their children, and insisted it was something “fully recognised” in the tax system.

Responding to the decision, the Prime Minister’s official spokeswoman said: “As the Prime Minister has said all along, he’d provided information, he’d added more if she wanted to investigate it, clearly she has made a decision not to.”