Scotland’s finance secretary Derek Mackay will unveil the annual budget at Holyrood on Thursday.

How much money is to be spent on hospitals, police, roads, infrastructure, schools and other devolved matters will be announced during a statement to the Scottish Parliament.

The money is a mixture of the Scottish Block Grant, revenues raised through taxation and borrowing.

The Scottish Government has limited control over what it can raise through tax and how much it can borrow, which will also affect the block grant (based on the Barnett formula) received from Westminster each year.

Unusually this year, the Scottish Government is setting its budget ahead of Westminster, with the Chancellor of the Exchequer Sajid Javid not announcing his taxing and spending proposals until March 11.

Previously, Holyrood has had to set its own budget within three weeks of the Westminster one.

Time difference

As a result of last December’s election, as well as the gridlock caused by Brexit and the Benn amendment, Boris Johnson’s government did not set a budget in the autumn, much to the upset of the Scottish Government and some local authorities.

Despite the indignation, the UK government maintained there was “nothing stopping” the Scottish Government setting out its budget ahead of the UK’s.

Mr Mackay said the government decided to present its budget ahead of the UK government’s (but, roughly at the same time of year as previous) so councils could be better briefed ahead of setting their own revenue plans before the end of the financial year.

Revenue raising

Around 40% of what the Scottish Government spends each year is raised from taxation. Once control of air passenger duty, aggregates levy and VAT raised in Scotland is fully devolved the Scottish Government hopes this can rise to as much as 50% of its revenue.

The Fiscal Framework, an agreement between the Scottish and UK governments which guides the block grant (money passed from Westminster to Holyrood), is impacted by projections on how much the Scottish Government will raise over the coming years via taxing the Scottish population.

Income tax

Income tax is collected UK-wide by HMRC and remains the responsibility of the UK government. Therefore it is not devolved.

HMRC also determines who and who isn’t a Scottish tax payer.

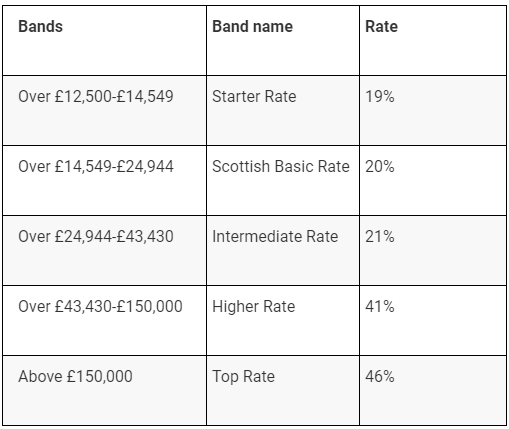

The Scottish Government can, however, set tax band thresholds and rates, as a result of the Scotland Act 2016.

For example, last year the Scottish Government set the following rates:

Air departure tax

The Scottish Government has the power to introduce Air Departure Tax (formally air passenger duty), but plans to cut it by the SNP have been repeatedly delayed.

The party had originally planned on abolishing the charge , but following pressure from environmentalists and the party’s pivot on the “climate emergency” a manifesto change has seen this position scrapped.

Land and Building Transaction Tax (LBTT)

Land and Buildings Transaction Tax (LBTT) replaced UK Stamp Duty Land Tax (SDLT) in Scotland in April 2015.

It is applied to residential and commercial land and buildings transactions where a chargeable interest is acquired.

Social security

For the first time Social Security will be fully devolved, which the Fiscal Commission noted would be “an increase both in the size of the Scottish Budget and in the fiscal risks to which it is exposed”.

Council budgets

Local authorities in Scotland have the ability to raise council tax by as much as 4.79%. This is not to be confused with other tax revenues in Scotland and does not contribute to the Scottish Government’s revenue powers.

The council tax rate has to be set by local authorities before April 1, by law.

Council revenue budgets, however, are dependent on the core settlement passed on by the Scottish Government. Last year this stood at just over £10.8 billion for all 32 authorities.

ANALYSIS: Rip it up and start again?

Thursday’s budget will mainly revolve around projections – forecasts on how much the block grant will come to, how much revenue will be raised over the coming years through taxation and how much the government will be able to borrow.

In turn, the “trickle down” could still change depending on the Westminster budget set for March 11.

There could be more money for Scotland, or less, dependent on complicated sums carried out via the Barnett Formula.

Chancellor Javid and the Boris Johnson government has declared an end to austerity, which should in theory see an increase in public spending projects UK-wide.

This in turn should lead to an increase in the Barnett consequential (or, for every pound announced, Scotland will get a percentage toward its block grant).

Where that money ends up, however, is at the discretion of the Scottish Government (once it has its budget approved by the Scottish Parliament).

Council leaders in particular will be watching Thursday’s announcement with bated breath, their revenue budgets – and more importantly what they might have to cut – determined by the decisions announced in Holyrood’s chamber.