Dunfermline-based businessman Peter Ferguson is one of hundreds of company bosses caught up in controversy over the government’s bounce back loan scheme.

Mr Ferguson, whose company was behind the ill-fated Party at the Park in Perth, has been banned by the Insolvency Service from becoming a company director.

He is one of hundreds of directors now thought to have benefitted from loans they weren’t entitled to.

The Insolvency Service say Mr Ferguson, through his events company Beautiful Digital Events Limited, applied for a £50,000 government loan amid the height of the coronavirus crisis.

Who is Peter Ferguson?

Businessman Mr Ferguson has long connections to events management companies.

As well as the now-defunct Beautiful Digital Events Limited (BDEL), which traded from Dulloch in Dunfermline, the 46-year-old had connections to several other companies.

One of his other businesses organised the popular Party at the Palace event in Linlithgow.

Hoping to replicate the success of this event, Mr Ferguson also organised Party at the Park in South Inch, Perth, which had to be cancelled due to Covid-19.

The event was re-organised for June 2022 before being cancelled for a second time, with ticketholders issued a refund.

In his now-deleted LinkedIn profile, Mr Ferguson, who lives in Edinburgh, was listed at chief executive of BDEL and as a graduate of Robert Gordon University in Aberdeen.

Poker win

Earlier this year, on a holiday in Las Vegas, Mr Ferguson hit the headlines after turning an £11.50 bet into a £213,000 poker win.

But Mr Ferguson has since featured in a BBC report on the bounce back scheme, leading to renewed interest in his business affairs.

Why was Peter Ferguson banned as a company boss?

In April the Insolvency Service listed a six-year sanction against Peter Ferguson, banning him from being a director of any company.

A BBC report suggests up to 16,000 businesses may have gone bust before paying back Covid-support loans issued by the UK Government.

Mr Ferguson is among the company directors who have been sanctioned as a result of applying to the scheme, despite being allegedly ineligible.

The Insolvency Service says a company had to be active before March 2020 in order to be eligible.

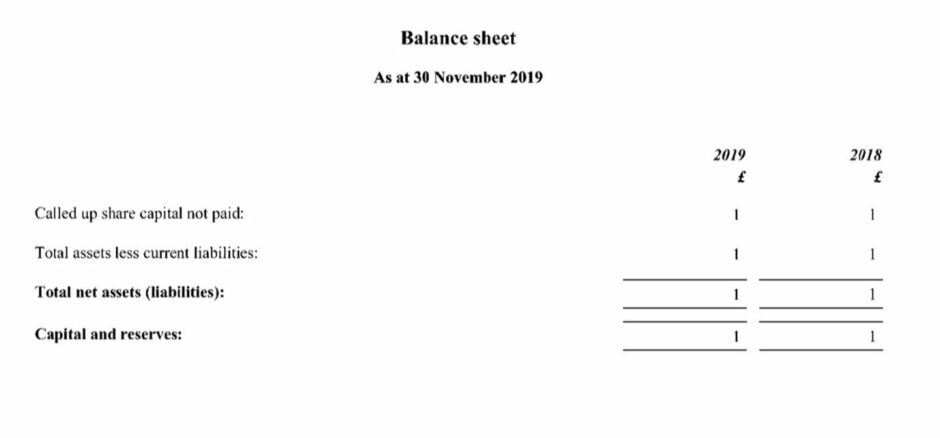

Despite applying for the £50,000 cash boost, BDEL had filed dormant accounts in November 2019 and 2020 — which means it did not meet the eligibility criteria.

The company posted a £210,000 turnover to support its application, despite dormant accounts from 2019 showing net assets of £1.

The company was still able to obtain the loan, which the government says Mr Ferguson used to purchase two vehicles worth more than £19,000.

‘Deep sorrow’ at company liquidation

In addition, he also withdrew an additional £13,515 in salary, dividends and bank transfers.

In a statement, Peter Ferguson said he had been advised to place BDEL into liquidation before the loan was repaid.

He said: “Like for many small business owners, the pandemic was a difficult and stressful time.

“As a Director, I was not eligible for any self employment grants and was therefore reliant on salary or company dividends.”

Mr Ferguson added that with in-person events “wiped out overnight”, he sought the loan to move into the digital events space.

He added: “Despite our best efforts and much to my deep sorrow, this service failed. It remains to this day a source of regret and I am incredibly grateful for the government’s assistance at the time.

“I subsequently turned to a UK Government approved and accredited insolvency practitioner for advice.

“With full access afforded to company accounts and financial records, I was advised to liquidate the company, having been willing to repay the loan up to that point.

“I am fortunate that my business is now getting back on its feet. I know how lucky I am compared to others less fortunate therefore I will be making an ongoing commitment to a charitable cause to help those whose lives were devastated by Covid.”

Conversation