Perth and Kinross Council plans to double council tax on second homes.

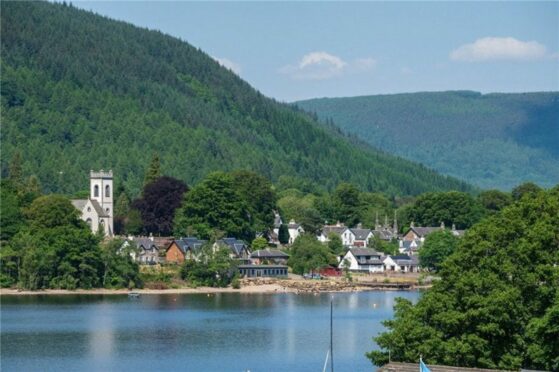

The region is hugely popular with second home owners. Areas such as Dunkeld, Pitlochry, Aberfeldy, Loch Tay and Blair Atholl are particular hotspots.

More than 1,100 second homes are registered across the region’s 12 council wards.

Some second homes in Scotland receive a 50% discount on their council tax, however local authorities have the power to vary the charge and the majority now pay the full rate.

Second home owners in Perth and Kinross have been charged the full, 100% council tax rate since 2017.

Last month the Scottish Government published draft legislation that will allow local authorities to charge up to double the full rate of council tax on second homes.

Perth and Kinross Council plans to be one of the first local authorities to do this, with council tax on second homes set to double from April.

Right thing to do

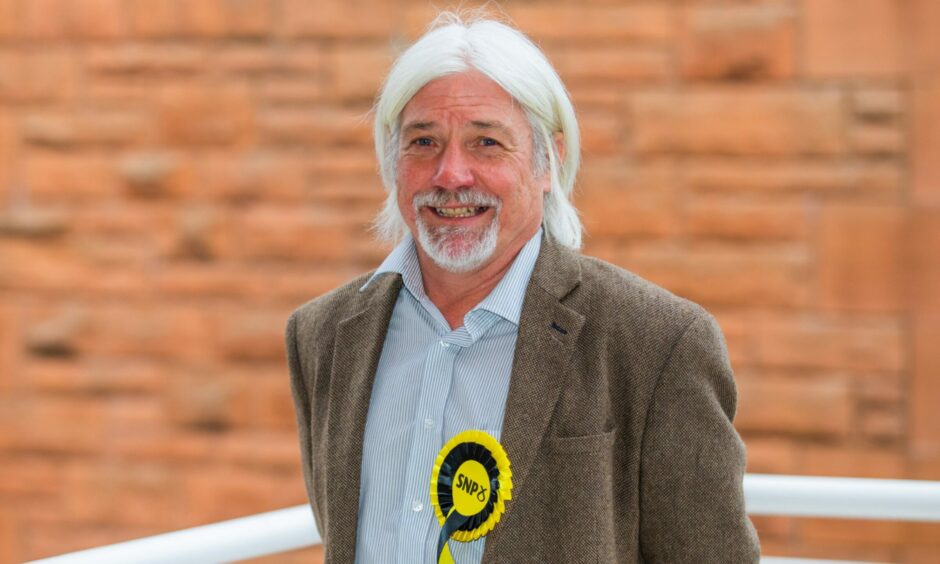

While the move is not welcomed by those who buy-to-let or own holiday homes in the area, Council leader Grant Laing says it is vital to help protect housing stock for people who want to settle there.

He said: “In Perth and Kinross we are lucky enough to live in an area of outstanding natural beauty that, naturally, attracts visitors from all over the world.

“Tourism is a major part of our economy and we have more than 1,100 properties that are currently classified as second homes.

“This means they are not someone’s primary residence but are occupied for more than 25 days a year. It also means there are more than 1,100 properties not available for the local community.

“Second homes can bring benefits to their local communities, but they also restrict the availability of housing making it difficult, if not impossible, for those who live and work there to rent or buy.

“It’s not just a problem in Perth and Kinross – there are similar issues across many parts of Scotland and the UK. In Wales, the council tax premium is 300% in some areas.

“When the Convention of Scottish Local Authorities (Cosla) carried out public consultation on increasing council tax on second homes, more than half of all respondents were in favour of it.

Raising £2 million

“The new charge will raise an estimated £2 million in Perth and Kinross next year.

“This year money raised will help protect jobs and protect services, and in the future half of the money raised will go towards affordable or social housing in rural areas where it is needed the most.

“When people holiday in Perth and Kinross, whether they’re staying in a hotel, rental accommodation or a second home, their stay is only possible because of the people who live and work here.

“Pricing those people out of the housing market diminishes the area for the community and those who want to holiday, or own a second home, there.

“The new council tax arrangements bring these homes into line with those for long-term empty properties.

“There is no single silver bullet that will address the shortage of affordable housing in rural areas but this is about helping create balanced communities where those who grew up in an area have more of a chance of owning a home there.

“It’s also about protecting the very nature of the communities that makes people want to live, work and holiday there.”

Don’t double tax second homes

Not everyone agrees that doubling council tax on second homes is a good idea, however.

David Corrie is partner and head of estate agency for Galbraith. According to him, second homes can bring vital investment, particularly into rural areas.

He said: “Scotland’s natural beauty, pace of life and lower costs (relative to other parts of the UK) has long made it attractive for additional home ownership.

“Second home owners purchase and use their property for a variety of reasons, but we predominantly see ‘pre-retirees’ purchasing a home to move to in future years, which they enjoy when able as their working lives permit.

“These homes are often let out for much of the year which brings visitors to the area, who enjoy and contribute to the local services and venues, often in rural areas. In most areas, visitors are very much welcomed.

Bringing buildings back into use

“In many parts of Scotland, including Perth and Kinross, disused traditional former agricultural buildings or steadings are standing empty – if these are renovated for a holiday let the architectural heritage is restored, without cost to the public purse.

“This in turn creates employment for builders, joiners, electricians and other trades employed on the renovation project.

“One of the main problems contributing to the scarcity of affordable rural homes is the lack of small parcels of land in local plans made available for housing projects.

“Local Place Plans, introduced in the Planning (Scotland) Act 2019, enable local communities to proactively contribute to the planning system. This offers the opportunity to resolve issues which are holding communities back, such as a lack of rural housing.

“Where landowners, rural businesses and local communities work together to agree priorities and bring forward proposals for development, this can result in the most exciting proposals for an area, meeting local housing needs and boosting economic growth.

“This type of joined-up thinking would be one way to help create and sustain thriving communities in rural areas.”

What do you think about the proposed tax change? Have your say below.

Conversation