A former SNP minister has demanded that the Bank of England fund a £6 billion rescue package for the Scottish economy this year.

Alex Neil said the only possible solution to the current crisis was for Holyrood to be allowed to use the central bank in the same way as the Westminster government.

In a debate on the nation’s economic recovery in the Scottish Parliament on Monday, the former health secretary insisted it was time to scrap current devolved borrowing limits and “throw the fiscal framework out the window”.

But Scottish Liberal Democrat leader Willie Rennie branded remarks about the Bank of England “ridiculous”, while Scottish Conservative MSP Murdo Fraser said that scrapping the framework would end protection against declining tax revenues.

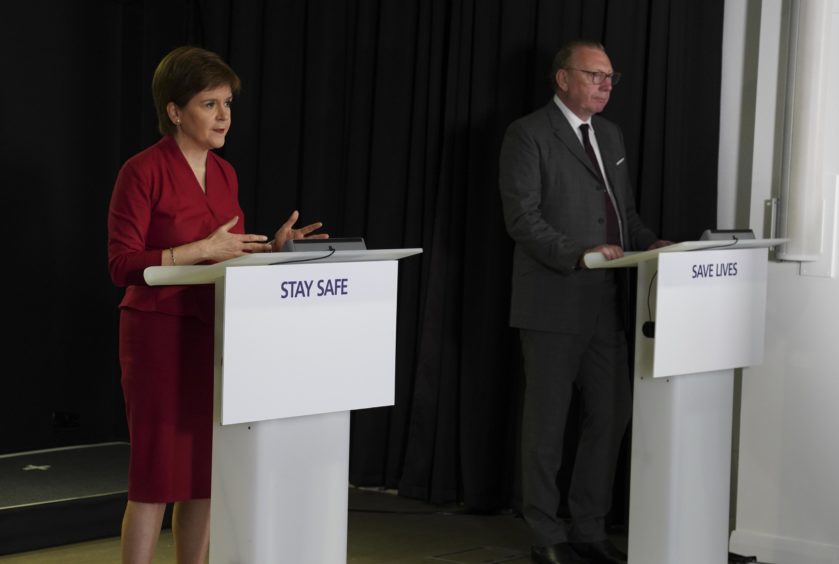

Benny Higgins, chairman of the Scottish Government’s Advisory Group on Economic Recovery, pointed to a 4% economic stimulus announced by Germany on Monday.

He said such an intervention would represent about £6bn for Scotland, but that Holyrood could only borrow £450 million under the fiscal framework.

In a debate on Mr Higgins’ report on Tuesday, Mr Neil said that “there is only one plan that is possible” to achieve that scale of investment.

He said: “And that is for the Scottish Government – as well as all the other devolved governments in the UK – to be able to borrow directly the money needed for the economic recovery, directly from the Bank of England, on exactly the same terms and conditions as the UK Government is doing.

“Indeed, the governor of the bank said yesterday his job has been to rescue the UK Government from going bankrupt.

“And the Bank of England isn’t supposed to just be of England and for England – it’s supposed to be for the rest of the United Kingdom as well.

“And now is an opportunity for the UK Government to give the powers for the Scottish Government to have the same borrowing powers – paying no interest, like the UK Government, no timescale for repayment, like the UK Government, and the power to write-off any loans from the Bank of England, like the UK Government has already done with the money it borrowed for the recession.”

The Airdrie and Shotts MSP added: “So, presiding officer, throw the fiscal framework out the window, it is no longer fit for purpose, and give us some real short-term powers that we can use to save the Scottish economy.”

In March the Bank of England intervened in the economy with £200bn of quantitative easing, a process which has been compared to effectively printing non-existent money.

The remarks were criticised by Murdo Fraser, Tory MSP for Mid Scotland and Fife.

“He wants to throw the fiscal framework in the bin – is that the framework that protects the Scottish Budget against a decline in tax revenues?” he asked.

“He will need to explain how he makes up the £12bn annual deficit in Scotland’s finances, currently filled by the Union dividend, thanks to the fiscal framework that John Swinney negotiated on behalf of the Scottish Government.”

Meanwhile, Mr Rennie said it was “ridiculous” to suggest that the Bank of England was only working for England, while “ignoring the fact the job retention scheme, and the self-employment scheme, and the massive increase in Universal Credit contributions of £900m came directly to Scotland”.