Labour plans to force a Scottish Parliament vote on a higher top rate of tax for Scotland’s richest.

The party’s election campaign set out a policy to restore the 50p tax rate for people earning more than £150,000.

The SNP backed the move at the 2015 General Election but Nicola Sturgeon later ruled out a 50p income tax rate for the first year Holyrood has its new powers.

The Scottish Government gains control over income tax rates and bands in April 2017, as part of the devolution of new powers in the Scotland Bill.

Now Labour has tabled an amendment in a bid to force a vote on the tax issue at Holyrood during a parliamentary debate on Thursday.

The Scottish Government motion for debate proposes “creating a fair and prosperous Scotland” and “using the new devolved powers” to tackle inequality, including building 50,000 affordable homes.

Labour’s amendment adds that the parliament “recognises the need for a higher top rate of tax for the richest earners so that this can be redistributed to tackle wider inequalities” and increases the affordable homes target to 60,000.

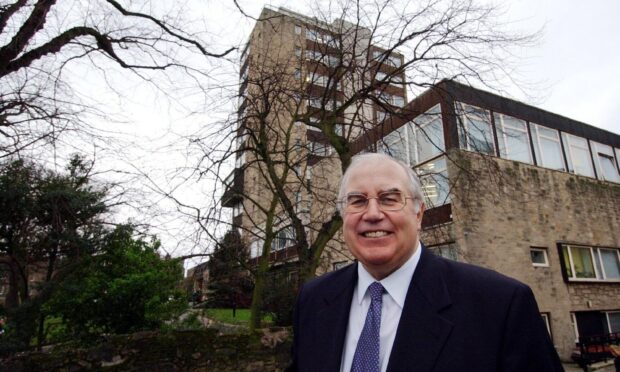

Scottish Labour deputy leader Alex Rowley said: “This vote is an opportunity for the SNP to make a simple choice – they can work with the centre left parties like Labour to stop the cuts and invest in our public services, or support the Tories to carry on with austerity.

“Labour will make the case that we should use the new powers over tax to introduce a 50p top rate of tax on the richest 1% earning over £150,000 a year.

“It’s the simple priorities we said we would adhere to in this parliament – tax the rich so we can invest in schools and stop the cuts to public services.”