Banks that shut branches should be slapped with a 50% tax on the proceeds from selling the sites, a professor has suggested.

Dozens of RBS branches are to close across Scotland in the coming weeks in the latest purge of physical banking.

Senior executives at the taxpayer-owner bank have refused to back down despite the impact on vulnerable customers and small businesses.

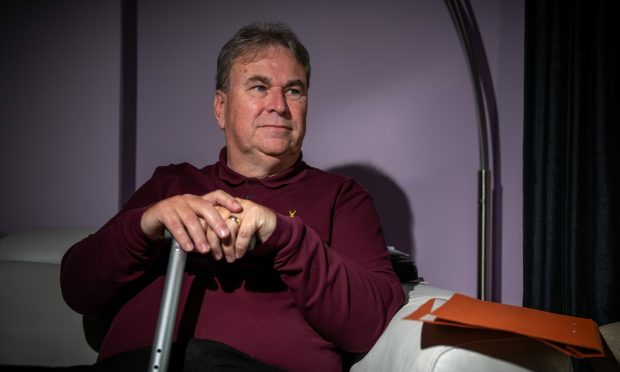

Cliff Beevers, a retired professor who has been campaigning against the programme, said the “horse has gone” in terms of saving the facilities.

But he told Holyrood’s banking inquiry that taxing the closures could mitigate some of the damage.

Prof Beevers said: “Why not a punitive tax on the banks when they sell their buildings of somewhere in the region of 50% of sale price?”

He added the money could be used “either to help the specific community or have it in a pot that could be used for people to bid for, for community use”.

He told Holyrood’s economy committee: “Maybe that’s a power you already have.”

A Scottish Government spokesman said any new national tax would have to be approved by Westminster.

“There needs to be a long term, sustainable banking service for all communities and the Scottish Government will continue to work with banks to ensure that essential services remain accessible to all,” the spokesman added.

“The Scottish Parliament cannot take a unilateral decision on this issue as any new national taxes would require the consent of Westminster.”

The Courier is campaigning against the closures because they will cut off society’s most vulnerable and make life even more difficult for small businesses.

The RBS branches to close in Courier Country are in Aberfeldy, Pitlochry, Perth South Street, Kinross, Dundee Stobswell, Dunblane and Montrose.

Comrie is one of 10 in Scotland that is undergoing a footfall review and is expected to learn of its fate later in the year.

The Unite union is staging a demonstration against the closures on Wednesday at 12.30pm outside RBS’ AGM at its headquarters in Edinburgh.