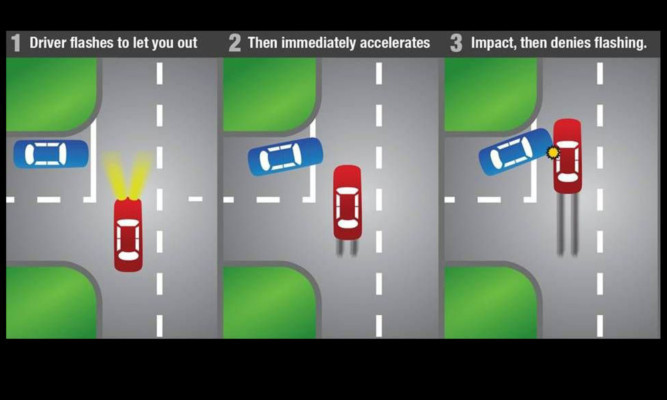

Motorists are falling foul of a new insurance fraud scheme dubbed “flash for crash”.

The latest tactic sees cars lying in wait for victims to exit from shops, car parks or fuel stations.

Fraudsters flash their headlights, offering the victim a right of way to join a main road, but then speed up to ensure their car is hit side-on.

The new tactic has been spotted, and given its name, by automotive anti-fraud investigation specialist APU, which said the flash-for-crash phenomenon had emerged as a worrying trend since the turn of the year.

“It is yet another example of how criminal gangs are becoming more sophisticated and attempting to stay one step ahead of suspicion,” said Neil Thomas, APU’s director of investigative services and a former detective inspector with West Midlands Police.

He went on: “The adoption of flashing headlights and beckoning the driver results in a ‘your word against mine’ situation when it comes to apportioning blame.

“By appearing to offer the right of way, the criminal simply continues his journey into a collision, holding the victim at fault for turning across him which, of course, cannot be denied under law.”

APU said some 380 false insurance claims are made daily, costing the motor industry £1.7 million a year and pushing up insurance premiums.

It added that the Insurance Fraud Bureau is currently investigating 49 rings, responsible for around £66 million in false claims.

RAC commercial director Kerry Michael said: “This is just the latest twist on ‘crash for cash’ which has been around for many years and causes many problems for both motorists and the insurance industry.

“This kind of fraud is manipulative and can be incredibly traumatic for the innocent individuals who get embroiled in claims against them, which are usually for whiplash and personal injury not for damage to the car as you might think.”

He went on: “The costs of this kind of fraud in the UK goes into the hundreds of millions and this, inevitably, can lead to the overall price of insurance premiums being pushed up to accommodate the losses underwriters have to bear.

“While this may seem like an individual act of selfishness or stupidity, often this kind of behaviour is linked to serious, organised crime. Unfortunately, following an accident this means that now more than ever motorists need to have their wits about them as much as the situation will allow.”

AA Insurance director Simon Douglas said: “This has the potential for causing serious injury or death and I’m glad that the police are taking this shocking crime seriously. I hope that the criminals are dealt with severely by thecourts.

“It is a also reminder to all drivers to be vigilant. The Highway Code says that you should only flash your headlights to let other road users know that you are there.

“It adds: ‘Do not flash your headlights to convey any other message or intimidate other road users. Never assume that flashing headlights is a signal inviting you to proceed. Use your own judgment and proceed carefully’.”

Mr Douglas went on: “Those who are victims of this crime should contact the police immediately and provide full information to their insurer.

“Insurance companies should take any cases like this very seriously and work with the police to get this criminal activity stopped.”