St Andrews University’s drive to raise £100 million for scholarships, teaching and research on its 600th anniversary could be scuppered by the Government’s controversial plans to restrict tax relief on charitable donations.

North-east Fife MP Sir Menzies Campbell, who is the university’s chancellor, is urging the Treasury to scrap its proposal amid fears it could have a serious adverse impact on the higher education sector.

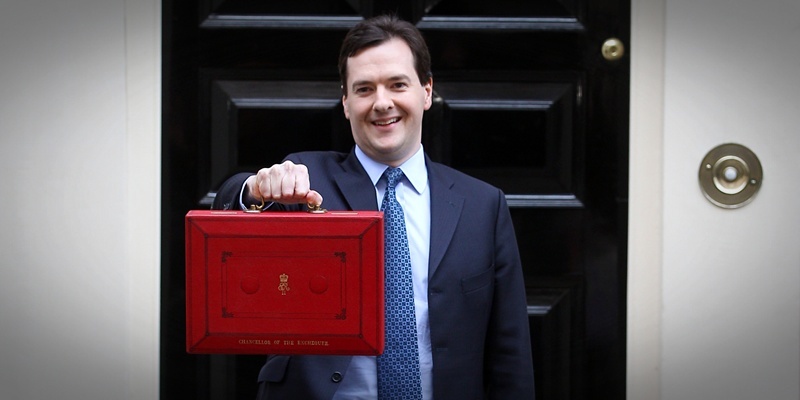

In a strongly-worded letter to Chancellor George Osborne, Sir Menzies warns of the ”considerable financial pressures” facing St Andrews and other Scottish universities.

The MP’s concerns come amid similar calls from Scottish Finance Secretary John Swinney, who has also asked Mr Osborne to rethink his plans, claiming that they will damage the third sector by reducing charitable donations.

Mr Osborne announced proposals to change the amount of tax relief donors can receive in respect of large donations to charities in his Budget last month.

From April 6 2013 the maximum will be £50,000 per year, or 25% of the donor’s income. This will result in a substantial reduction in the amount of tax philanthropists can claim back.

In his letter, Sir Menzies said: ”I am writing to you in my capacity as both MP and chancellor of St Andrews University which is currently engaged in its 600th anniversary celebrations. As part of these the university is endeavouring to establish an endowment fund of £100 million, a task made difficult in present economic conditions.

”Government policy has encouraged the university to seek financial support from sources other than public funds. You will understand therefore the dismay felt by St Andrews University (and others) by your announcement in the Budget that tax relief on charitable donations is to be restricted.”

Continued…

Sir Menzies said St Andrews University is recognised as a charity and pointed out that tax relief provides a valuable incentive to those considering whether to make donations.

He added that further consideration for Scottish universities is the Holyrood Government’s policy which prevents the charging of tuition fees to Scottish European citizens.

”The financial pressures on Scottish universities are as a result of these circumstances very considerable indeed, ” he said. ”To restrict tax relief in the way you have proposed can only add to these pressures.

”I therefore urge you to reconsider your proposals to change the existing tax regime so far as it affects charitable donations in general and universities such as St Andrews in particular.

”To proceed in the way identified in the Budget statement runs the serious risk of adverse impact on the higher education sector.”

St Andrews has so far raised around £30 million of its £100 million target and last week announced a major gift of more than £1 million from alumnus Gordon Bonnyman to fund scholarships in the arts.

However, the university says this is the kind of vital major gift under threat from the Budget proposals.

John Swinney has also written to Mr Osborne criticising his plans.

He warns that the proposals which have been condemned by high-profile philanthropists including Sir Tom Hunter, Sir Ian Wood and Willie Haughey will have an impact on charities, universities and cultural organisations which all rely on philanthropic giving to fund some of their activities.

Mr Swinney said: ”This Government recognises the valuable contribution charities make to Scottish society and we fully support the work of the charitable sector in Scotland.”

Photo by Lewis Whyld/PA Wire