Got a brilliant idea but don’t know how to fund it? You need crowdsourcing, discovers Caroline Lindsay.

Crowdsourcing, a term coined back in 2006, means asking for contributions, from a large group of people, and especially online, to raise funds for startup companies and community projects.

Kickstarter is the world’s largest funding platform for creative projects and since its launch in 2009, over $850 million has been pledged by more than 5 million people, funding more than 50,000 creative projects all over the world.

Graeme Buchan, from Dundee, who is writing a series of graphic novels called The Creepy Scarlett series and has launched a project through www.kickstarter.com to raise funds to complete issue four, is one such beneficiary of crowdfunding.

He explains: “The funds will be used to pay the artistic team, 10% fees and a limited run of print copies which will be available as rewards.”

Another Kickstarter success story is Perth-based amateur film-makers Samuel Horta and Mario Neves, whose project is to research and make a documentary about mysterious dog suicides in Dumbarton.

“In Dumbarton there’s an estate called Overtoun, famous for its bridge where hundreds of dogs have jumped to their deaths since the fifties.

“The Kickstarter project raised hundreds and the plan is to film the Overtoun estate and to do interviews with local people, local historians, with owners of the dogs that jumped the bridge, experts in mythology, social psychology, paranormal activity, animal behaviour and anthropology,” they explained.

A Canadian couple, Holly and Jon Granken, have launched a crowdfunding bid on www.gofundme.comto raise £4,000 to emigrate from their home in London, Ontario, to Edinburgh, after they fell in love with the city on a visit three years ago.

“I can’t really explain it we both just knew it felt like home,” said Holly, who is an artist.

Rewards are being offered as incentives: people making the minimum donation of £3 can expect “good karma”, while donations of £12 will receive a postcard from the couple once they move to Scotland. A £30 donor will receive an original drawing by Holly and anyone donating £60 will receive a signed photo of Edinburgh taken by Holly.

Aberdeenshire Brewery BrewDog has announced it has secured its £4.25m target for investment from its customers, sourced through a crowdfunding scheme.

More than 8,124 investors signed up for the 42,000 shares put on offer, priced at £95. BrewDog set out to raise £4m last June, and raised a quarter of that within 24 hours.

Meanwhile, in Larbert, members of the public can buy a share of a thoroughbred racehorse for a one-off payment of as little as £75 through the crowdfunding platform www.crowdcube.comthat allows racehorse trainers and syndicates to pitch for investment over the internet.

Businessman Lee Murray, who took over as chairman of East Fife Football Club last June, saw a perfect case for crowdfunding in the customers who turned up every week at the Bayview Stadium in Methil.

The club, the first in Scotland to do so, has announced it is going to use a funding model developed by Glasgow-based crowdfunding company Squareknot (www.squareknot.co.uk) to raise a total of £100,000 from fans, to develop a new shop, caf bar and a 750-seater stand.

Mr Murray said: “Although the club is operating within its financial means, there is little scope within the budget for capital spend on stadium enhancements and the directors do not believe that incurring significant levels of debt to fund capital projects is the correct approach for the club to take.

“For football clubs like East Fife it really is an essential way of funding as banks and the traditional ways of funding have all but dried up for small businesses like us and we must think outside the box. With this source our fans, who are also our customers, can really feel part of the club.”

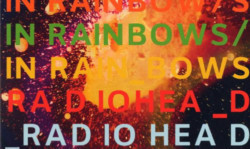

And the concept can be applied in the music industry, too. In 2007 Radiohead, one of the biggest-selling bands in music history, offered their fans a crowdshare experience by inviting them to pay as much or as little as they wanted to download their seventh album, In Rainbows.

Entrepreneur Amanda Boyle, a graduate of the University of Abertay, created her crowdfunding company, www.bloomvc.com, in 2010, when she spotted a funding gap for innovative ideas, community initiatives, startups and small business growth.

She explained: “The idea is simple: harness the power of the crowd that’s you, me and everyone around us and, in return for financial contributions, no matter how small, claim a reward from project owners.

“I started to think about crowdsharing finance as crowdfunding was called then back in 2010 and spent around 18 months researching, building a model and creating a team,” Amanda explains.

“Crowdsharing is a great concept because it allows people to engage with their natural and interested community, either to raise cash or to test ideas.”

So, is crowdfunding simply a buzzword for charity? “Absolutely not!” stresses Amanda. “Charities have very specific mission statements whereas crowdsourcing and funding is about getting things done.

“It takes away all the barriers and blocks that previously prevented people from doing something they would have loved to do but couldn’t. It’s not about handing over cash, it’s about involving people who are interested in what you’re doing.”