Prime Minister David Cameron has been accused of holding an over-simplistic view of how to tackle personal debt.

Mr Cameron was forced to drop part of his speech to the Conservative Party conference in Manchester at the last minute on Wednesday where he called on people to help the UK’s faltering economy by paying off their credit card debt.

However, the Prime Minister was forced to change his speech after criticism that it was unfair on poor households struggling on the breadline.

There were also fears the call could also trigger a drop in consumer spending that would harm the economic recovery.

Instead, he toned down his message and said people are already working to pay off their debts.

Scotland’s leading personal advice agency, Citizens Advice Scotland, said the Prime Minister obviously does not understand how people can become trapped in debt.

Head of policy Susan McPhee said: ”The Prime Minister is clearly failing to understand the problems faced by people who are in debt. He should get real and find practical ways of helping people address the problem.

”It is very simplistic to say that everyone in debt should simply pay off their debts and that would solve the problem.

”Most people who are in debt would love to do that, if only they could.

”But how can you pay off your debts if you’ve lost your job, or if your income is barely enough to cover your basic living costs from week to week?”‘Drowning in debt’Ms McPhee added: ”Scottish CAB advisers see people every day who are drowning in debt.

”The average debt among our clients is now well over £20,000. None of those people want to be in debt.

”People get into debt for a whole number of complex reasons, and every individual case is different, and needs an individual solution.

”It would perhaps be better if the government recognised that, and concentrated more on helping people stay out of debt in the first place, or on finding ways to stop small debts from snowballing into unmanageable ones.”

She added that people struggling with debt should seek help as soon as possible from organisations like Citizens Advice.

”Anyone who wants to get out of debt can get free, independent advice from their local CAB,” she said.

”We will give them expert help that is tailored to their unique personal situation, for example in many cases we can negotiate with creditors to make repayment easier.

”Of course we would welcome moves from the government to help people get out of debt.

”But these would have to be based on realistic and practical objectives, including better financial awareness, more affordable credit options, and more support for advice services.”’Living beyond our means’Shadow chancellor Ed Balls said: ”Families struggling with higher food and energy prices, rising unemployment and the VAT rise are already struggling to get by and are cutting back.

”They don’t need an out-of-touch Prime Minister lecturing them about paying off their credit cards.”

Mr Cameron’s comments came as growth for the second quarter of the year slumped (see above), thanks in part to a fall in consumer spending.

Alan Mitchell, chief executive of Dundee and Angus Chamber of Commerce, said it was unlikely Mr Cameron’s comments would harm the economic recovery by encouraging people to spend less.

He said: ”I’m not convinced that anything David Cameron make a difference to people.

”People have to make their own judgments.

”We want to see people spend in shops but we have been living beyond our means for years and we will have to tackle long-term debt.”

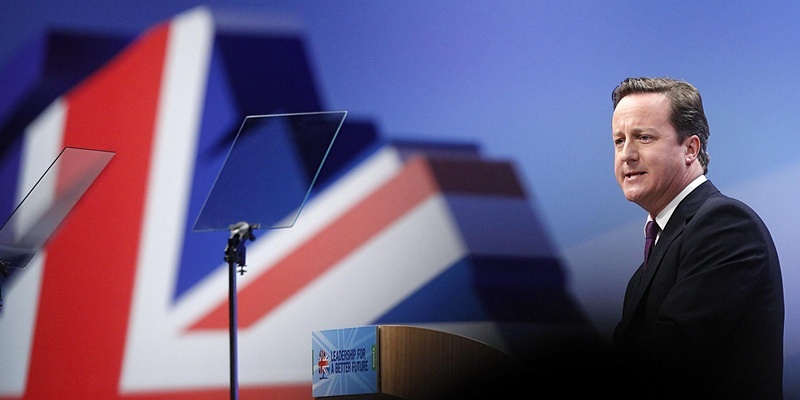

Photo PA.