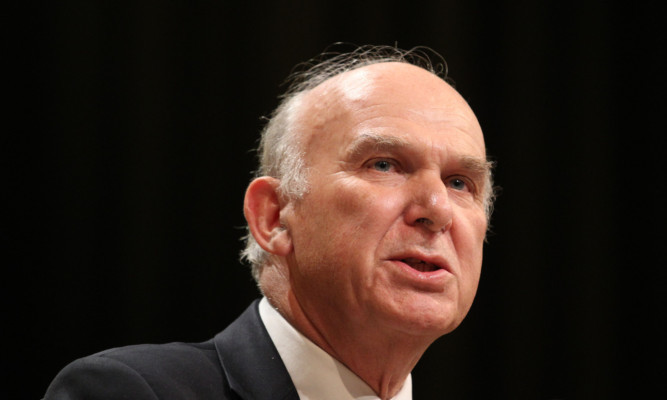

British tax havens are “shady places for shady people”, Business Secretary Vince Cable said, as he conceded that Government powers to stop tax avoidance are limited.

The Lib Dem was commenting after it emerged that telephone giant Vodafone had not paid corporation tax in the UK for the second year running.

“The Government is introducing this general anti-avoidance principle, which shifts the burden of proof somewhat and helps the Inland Revenue deal with these cases (of tax avoidance),” he said.

The coalition is also looking at introducing a Register of Beneficial Ownership, which could force individuals and companies to disclose any benefits they receive from assets registered under a different name, he went on.

However, he told Sky’s Murnaghan programme that, without a collective, international response, any efforts to deal with tax avoidance were “limited necessarily, because in a very complex world companies shift their profits and payments in a way that are very, very opaque, so you have to have tough international rules and the G8 might well take us forward in that.

Mr Cable would not say which British territories he was referring to when he said: “You could say there are shady places for shady people.”

On the economy, Mr Cable was cautious about sounding too optimistic.

However, he said: “There is a lot more confidence around these last few months, that’s for sure. Businesses are more optimistic, consumers are more optimistic. There is good employment data. I think we’ve all been pleasantly surprised that unemployment hasn’t been much higher.”

The main obstacles to economic growth were a lack of exports and the banks failing to lend more.

He described limited lending by the banks as “massively frustrating”, saying “It totally undermines our recovery.”